Finding the best bank account is becoming increasingly important in times of rising costs. That’s why we’re showing you the top 5 free bank accounts as well as selected premium accounts. In our detailed checking account comparison, we present the best options based on the most important criteria!

The best bank accounts in comparison

Berliner Volksbank Bank Account

- Deal: 200 Euros bonus

- Account Fee: 3.95 Euros per month

- Cash Withdrawals: Free at VB ATM’s

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Girocard and Mastercard credit card included

BBVA Bank Account

- Deal: 20 euros with code BONUS

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free within the EU zone from 150 Euros

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Mastercard debit card

- Tested by Stiftung Warentest 12/25

ING Bank Account

- Account Fee: 0 Euro per month with 1,000 Euros incoming payments

- Cash Withdrawals: Free within the EU zone

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: VISA debit card

- Savings account with 2.75% p.a. interest

C24 Bank Account

- Deal: 75 Euros bonus

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free worldwide up to 4 times per month

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Mastercard debit card

- Tested by Stiftung Warentest 12/25

bunq Bank Account

- Account Fee: 0 Euro per month

- Cash Withdrawals: 2.99 Euros per withdrawal

- Foreign Currency Fee: 0 Euro worldwide up to 1,000 Euros per year

- Card Type: Mastercard debit or credit card

- 2.01% p.a. interest on savings account

To find the best provider for your individual financial needs, it is important to thoroughly compare the terms and conditions of different bank account models, for example, the accounts offered by branch banks such as Commerzbank, Santander, and Targobank, with those from direct banks like DKB and comdirect or neobanks such as N26 and Revolut.

Inhaltsverzeichnis

Many banks also offer free current accounts with a bonus. By the way: if you’re looking for the best credit card – whether with or without a checking account – we recommend taking a look at our credit card comparison!

What types of bank accounts are there in Germany?

A checking account has become indispensable in everyday life, as it is a product that manages all your financial matters. With a bank account-legally also called a payment account-you can store your money, make payments, and deposit or withdraw cash.

Nowadays, most current accounts are managed via mobile online banking, which makes everyday transactions much easier. However, there is now a wide variety of providers, so it’s easy to lose track.

Before we look at the features of individual bank accounts, it’s worth taking a look at the types of bank accounts that exist in the first place.

This is mainly because certain types of current accounts generally offer specific advantages that some people may find valuable, though of course, that is not a given. After all, everyone has different requirements for a checking account, so it’s important to consider this carefully.

Branch bank or direct bank?

The first major difference, similar to business accounts and investment accounts, lies in the type of bank offering the account. In most cases, you need to choose between a branch bank and a direct or neobank.

If you value physical branches and personal contact beyond phone or online support, you should definitely choose a branch bank and apply for your current account there. The most important branch banks offering bank accounts in comparison are the following:

- Commerzbank

- Deutsche Bank

- Hypovereinsbank

- Postbank

- Sparda-Banken

- Sparkassen

- Volks- and Raiffeisenbanken

Berliner Volksbank Bank Account

- Deal: 200 Euros bonus

- Account Fee: 3.95 Euros per month

- Cash Withdrawals: Free at VB ATM’s

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Girocard and Mastercard credit card included

Santander BestGiro Bank Account

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free within Germany

- Foreign Currency Fee: 1.85% on the total amount

- Card Type: VISA debit or credit card

- Optional: Free credit card available

Commerzbank Bank Account

- Deal: Up to 150 Euros bonus

- Account Fee: 4.90 Euros per month

- Cash Withdrawals: Free within the EU zone

- Foreign Currency Fee: 0 Euro within the EU zone

- Card Type: Girocard with V PAY

Postbank Bank Account

- Deal: 30 Euros bonus

- Account Fee: 0 Euro per month with 900 Euro incoming payments

- Cash Withdrawals: Free within Germany

- Foreign Currency Fee: 1.85% + 0.5% currency conversion fee

- Card Type: Mastercard debit card

Deutsche Bank BestKonto Bank Account

- Account Fee: 13.92 Euros per month

- Cash Withdrawals: Free at Deutsche Bank and partner banks ATM’s

- Foreign Currency Fee: 1.00% + 0.5% currency conversion fee

- Card Type: Girocard and Mastercard credit card included

- International travel health insurance included

All of these banks usually offer a bank account, which in many cases is free of charge or at least advertised as such (more on this in the next section). In any case, you have the advantage of having a local presence of the bank where you can address and resolve any issues and seek advice.

Depositing cash is also much easier and better with a current account at a branch bank, although modern technologies are changing this.

However, since branch banks have to operate an expensive network of locations, bank accounts here usually involve costs or offer significantly poorer services than accounts at the numerous direct banks.

So if you want a lot of services, which we will explain in more detail in another paragraph, you should opt for a checking account with a direct bank. In certain circumstances, it may also make sense to combine both and have an account with both a direct bank and a branch bank.

Tip: Branch banks are usually the first port of call when looking for a bank account. However, the best option for your own needs is rarely one of the well-known banks. A detailed comparison of checking accounts is therefore advisable!

Free bank account

The most important distinction of bank accounts, after looking at the issuing bank, is certainly the question of whether the account is free of charge or not. With regard to the previous section, there are free current accounts offered by both branch banks and direct banks.

However, as a general rule, it can be assumed that current accounts from direct banks have fewer hidden costs and also offer better services. Here is an overview of the most important free bank accounts in comparison, which we have divided into offers from direct or neo-banks and traditional branch banks.

Direct and Neobanks:

- DKB bank account

- N26 bank account

- comdirect bank account

- Consorsbank bank account

- Revolut bank account

- C24 bank account

- ING bank account

- 1822direkt bank account

- Vivid Money bank account

Berliner Volksbank Bank Account

- Deal: 200 Euros bonus

- Account Fee: 3.95 Euros per month

- Cash Withdrawals: Free at VB ATM’s

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Girocard and Mastercard credit card included

BBVA Bank Account

- Deal: 20 euros with code BONUS

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free within the EU zone from 150 Euros

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Mastercard debit card

- Tested by Stiftung Warentest 12/25

ING Bank Account

- Account Fee: 0 Euro per month with 1,000 Euros incoming payments

- Cash Withdrawals: Free within the EU zone

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: VISA debit card

- Savings account with 2.75% p.a. interest

C24 Bank Account

- Deal: 75 Euros bonus

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free worldwide up to 4 times per month

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Mastercard debit card

- Tested by Stiftung Warentest 12/25

bunq Bank Account

- Account Fee: 0 Euro per month

- Cash Withdrawals: 2.99 Euros per withdrawal

- Foreign Currency Fee: 0 Euro worldwide up to 1,000 Euros per year

- Card Type: Mastercard debit or credit card

- 2.01% p.a. interest on savings account

Free bank accounts from Branch Banks:

- Commerzbank Free bank account

- Targobank bank account

- Wüstenrot Girokonto S

- Santander BestGiro

The problem with a “free” checking account is that it’s quite possible for an account to be marketed as free, but then come with numerous pitfalls and additional costs.

Unlike a free credit card, where you mainly need to watch out for the annual fee, a free bank account requires much more attention. Besides account maintenance or basic fees, the main issue is usually the minimum monthly deposit requirement.

If you are unable to deposit a certain amount each month, a fee will be charged. This can be especially frustrating if you initially assumed the account was truly free.

In addition, even with the required deposit, costs can still arise for transfers or using the debit card. Since these functions are fundamental, this ultimately means that your current account isn’t really free. A comprehensive summary of all the pitfalls of a supposedly free bank account can be found on a dedicated page.

Premium bank accounts with additional benefits

Similar to credit cards, there are numerous premium bank account offers that, while not free, aim to provide significantly more value.

Branch banks remain particularly strong in this area, as the service aspect is often important for premium accounts. However, there are also premium offerings from online banks that can be worthwhile. Here’s an overview of the most important bank accounts in comparison:

- Deutsche Bank BestKonto

- Postbank GiroPlus

- Commerzbank PremiumKonto

- Hypovereinsbank ExklusivKonto

Especially for travel and related benefits, a premium current account can be a good investment, as these accounts usually include a premium travel credit card. Additionally, there are many other advantages with a premium account, which we cover in detail on a dedicated page.

Business accounts for companies and self-employed individuals

The last type of bank account worth considering is the business account. As the name suggests, these accounts are designed exclusively for self-employed individuals, freelancers, and entrepreneurs to manage their business transactions.

Here too, there are significant differences, and the market has been increasingly shaped by fintechs and new providers. We examine these in more detail in our business account comparison for freelancers and self-employed individuals. The accounts we believe are worth noting are:

- Qonto

- Postbank Business Account

- N26 Business Account

- Kontist

- bunq

- Holvi

Commerzbank Klassik Business Account

- Free account management for the first 12 months

- Up to ten free transfers per month

- Debit card included

Deutsche Bank Basic Business Account

- Basic plan for low usage – 14,90 Euro per month

- Paperless transactions for 30 Cent each

- Cash deposits and withdrawals for 3,00 Euro per transaction

- Deutsche Bank Card included

Commerzbank Premium Business Account

- Promotion: 100 Euro Online Bonus

- 29,90 Euro per Month

- Digital and Online Banking

- 50 free paperless payment orders per month

- Debit Card and Business Card Premium included

Deutsche Bank Premium Business Account

- Ideal for customers with high account activity

- 39,90 Euro per Month

- Includes two BusinessCards (credit cards)

- Digital transactions at 0,10 Euro per item

Commerzbank Founder Business Account

- Promotion: 100 Euro Online Bonus

- 17,90 Euro per Month (40% off the regular premium account)

- Up to 100 Euro additional bonus possible

- 50 free electronic transactions per month

- Debit card and Business Card Premium included

In contrast to personal bank accounts, there are significantly fewer providers offering a free business account, partly because business customers are generally more willing to pay.

If you have many transactions and run an active business, you will usually need to spend more, as most “free” current accounts for self-employed individuals come with high ongoing costs when used actively.

As with personal accounts, there is also a close connection between business accounts and business credit cards. So if you’re looking for a business account, you should consider these as well. We also have a dedicated page for the numerous business accounts, showing what to look out for with free company accounts and business accounts from digital providers!

What aspects and features matter in a bank account comparison?

Nowadays, it is difficult to manage everyday life without a checking account, as almost all payment transactions that affect an individual are processed through a current account. In general, a bank account is a type of standard account that every citizen needs to manage their finances, access cash, and make payments.

Your bank account is always held at a bank, often referred to as your “house bank.” However, the differences in services offered by various providers can be quite significant, so it’s worth making a comparison.

When choosing a current account, it also depends heavily on which features are important to you. Below, we take a closer look at the most important aspects.

Fees for bank accounts

Perhaps the most important aspect when comparing checking accounts is the fees that may apply. In this area, online banks – also called direct banks – have brought significant change to the market, as almost all banks now offer a free current account.

However, these “free bank accounts” increasingly come with pitfalls, meaning the account is not truly free despite bold promises. This is partly because banks, following the low-interest phase, need to earn more money from fees. It is therefore always worth studying the terms and conditions carefully.

In general, when comparing checking accounts, you should keep the following fees in mind:

- Account maintenance fees

- Fees for debit cards (Girocard) and credit cards

- Foreign currency fees

- Fees for account transactions (transfers, etc.)

- Interest on overdrafts (disposition credit)

Although every bank advertises having the best bank account, no bank offers an all-encompassing perfect account. Instead, you need to consider which costs would apply based on how you use the account and make your decision accordingly.

Account maintenance fees

Account maintenance fees are essentially the basic fee for a checking account. If such a fee applies (which is usually not the case with a free bank account), a certain amount is charged per month for being able to use the account.

In many cases, this fee is also linked to how actively you use the account – more specifically, whether and how much money is deposited into the account each month. This is usually referred to as a minimum monthly deposit (often also called a salary deposit).

💡 Many free accounts are only truly free if you exceed a certain amount of incoming payments each month (usually between €700 and €1,500). Some banks explicitly require a salary payment, while others only require a general incoming transfer.

Fees for debit or credit cards

Fees for debit cards (Girocard) and credit cards are additional charges, independent of the account maintenance fee. If such fees apply, you pay them regardless of the basic account fee simply for receiving a debit card or a credit card from the bank for the respective account.

With very few exceptions, you should definitely avoid these costs, as there is a wide range of free offers available. Especially in the credit card sector, there are many options that do not require a current account and can be used in addition to an existing account.

For this reason, it’s also worth taking a look at our credit card comparison, where you can filter offers according to your individual financial needs.

Foreign currency fees

Foreign currency fees on bank accounts usually apply to the debit card (Girocard) or credit card that is part of the account. If you use these cards abroad or in a foreign currency, many accounts require you to pay an additional fee.

Unfortunately, most accounts come with such fees, especially free checking accounts. However, this is not a major issue, as these fees can be relatively easily avoided – for example, by using a credit card that does not charge foreign currency fees.

Transaction fees

Fees for account transactions are a particularly popular way of turning a free bank account into a paid one. These fees apply whenever you use the account for anything.

Whether you make a transfer, withdraw cash, or have a charge debited from your current account, fees may be charged if you have the wrong account. It is often the case that accounts with such fees include a certain monthly allowance of free transactions.

Interest on account overdrafts

Finally, interest on account overdrafts is also worth mentioning. Regardless of which free bank account you choose, you should avoid overdrafts whenever possible, as they not only involve costs but also carry the risk of falling into debt.

Each time your account balance goes negative – meaning you spend more money than is available in your account – you are effectively granted a loan, which is subject to interest at a rate that varies depending on the current account. If this situation occurs even occasionally, you should definitely take overdraft interest rates into account when choosing a checking account.

Note: bank accounts can have vastly different interest rates for overdraft facilities depending on the bank. You should compare these carefully to find the best offer for you.

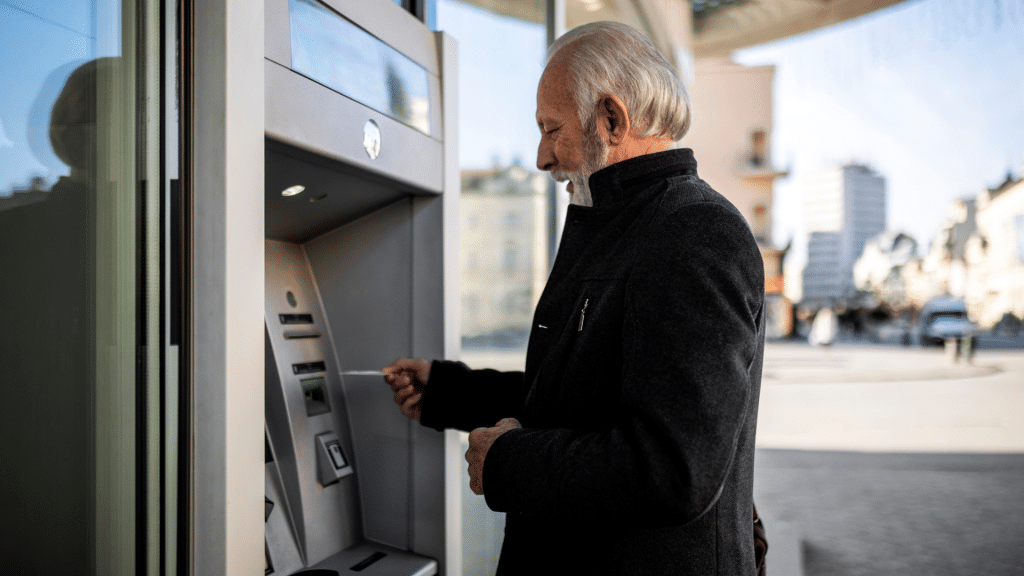

Cash withdrawals

One of the most important features of a checking account – whether free or not – is the ability to withdraw cash. In general, this is possible with any bank account, either via a debit card (Girocard) or a credit card.

However, both the fees and the restrictions on withdrawals can vary significantly and make a major difference when choosing the right bank account. In general, the following questions are important when it comes to cash withdrawals:

- Are cash withdrawals generally free of charge?

- At which ATMs or partner networks are withdrawals free?

- How often are free withdrawals allowed?

- Are there any additional restrictions?

As you can see, cash withdrawals – especially when described as “free” – are not as straightforward as they might seem. You should therefore definitely take this aspect and any potential withdrawal fees into account when choosing the best current account for you.

Usability & security

Often underestimated aspects of a bank account comparison are the technical features offered by each bank. For example, how good is the bank’s website, and how easy is the online banking experience to use?

Which TAN (transaction authentication) method is used, and how secure is it? Is there a mobile app, and how well does it work? You should consider all of these questions before applying for a new checking account, as apps, websites, and online banking are playing an increasingly important role in modern current accounts.

These aspects also include whether modern payment technologies such as Apple Pay or Google Pay are supported, and of course how quickly a bank adopts them after their release.

Service & customer support at the bank

The level of service a bank provides to its customers is also often underestimated. Especially when an account is free of charge, people may doubt whether good service can be expected at all. Nevertheless, the differences here are significant and can be very relevant in everyday life.

For example, if you lose your debit or credit card, how quickly will you receive a replacement? And what happens if you encounter problems with your payment method while abroad? In such situations, it’s important to be able to rely on good customer service and to be able to reach the bank at all times—which is not the case everywhere.

How does opening and switching a bank account work in Germany?

When applying for a new bank account, it’s also important to understand how the application process works and what to look out for. At first glance, switching current accounts may seem tedious and time-consuming.

However, both processes are actually less complicated than you might think, thanks to modern technology.

Opening a bank account: how it works

Opening a bank account in Germany is very straightforward, similar to opening a savings account. On the bank’s website, you fill out the application form and provide all the required information. Your application is then processed and usually approved or rejected within a few minutes.

In addition, you must complete an identity verification step, which can be done in one of two ways. You can either verify your identity at the German Post Office (PostIdent) or, with most banks, online via the so-called VideoIdent procedure.

With some banks, the application is still reviewed manually, meaning the contract is sent to you by post after the review is complete. You then need to sign it and send it back before completing the identity verification.

This can make the process take a bit longer, although fewer and fewer banks still use such a complex procedure. With branch banks, it is sometimes necessary to open the account in person at a local branch, where you can also verify your identity and provide the required signatures on the spot.

After that, you will receive your debit card (Girocard) and, depending on the account, your credit card by post. The login details for online banking and the PIN codes for the cards are usually sent separately, ensuring a high level of security. You can then use the delivered cards immediately and usually log in to your account online right away.

What can make opening a bank account particularly attractive is that banks often offer very appealing bonuses for signing up. Banks are highly interested in gaining new customers and therefore regularly offer generous welcome gifts such as sign-up bonuses, starting credit, or even miles and points. If used correctly, the latter are usually much more valuable than a simple cash bonus.

❗ Note: In Germany, there is no legal limit on the number of bank accounts you can have. From a purely legal standpoint, you can open as many checking accounts as you like.

Switching checking accounts: easier than you think

After opening a new current account, there are several tasks to take care of. SEPA direct debits need to be updated so that companies that collect money from you on a monthly basis are informed of your new bank details.

However, most digital banks offer a switching service that allows you to outsource the entire account transfer process. This is extremely convenient and enables you to switch your bank account within minutes.

All relevant connections to your old account are reviewed, and the associated companies are automatically informed of your new bank details.

Once the process is complete, all direct debits and recurring payments should be automatically collected from your new checking account, and you can simply close your old account.

While you are not required to do so – since it is perfectly possible to have multiple bank accounts – it is still advisable to close the old account after some time, as having multiple accounts does not necessarily help your SCHUFA credit score.

Which bank account is the best?

If you keep all of the above aspects in mind, you’re already one step closer to choosing the best account. Nevertheless, in most cases it’s still worthwhile to compare the key checking account models with one another in order to secure the best terms.

Which bank account is actually the best for you, however, always depends on your individual financial needs. We have put together and compared an overview of the best checking accounts in Germany:

Berliner Volksbank Bank Account

- Deal: 200 Euros bonus

- Account Fee: 3.95 Euros per month

- Cash Withdrawals: Free at VB ATM’s

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Girocard and Mastercard credit card included

BBVA Bank Account

- Deal: 20 euros with code BONUS

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free within the EU zone from 150 Euros

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Mastercard debit card

- Tested by Stiftung Warentest 12/25

ING Bank Account

- Account Fee: 0 Euro per month with 1,000 Euros incoming payments

- Cash Withdrawals: Free within the EU zone

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: VISA debit card

- Savings account with 2.75% p.a. interest

C24 Bank Account

- Deal: 75 Euros bonus

- Account Fee: 0 Euro per month

- Cash Withdrawals: Free worldwide up to 4 times per month

- Foreign Currency Fee: 0 Euro worldwide

- Card Type: Mastercard debit card

- Tested by Stiftung Warentest 12/25

bunq Bank Account

- Account Fee: 0 Euro per month

- Cash Withdrawals: 2.99 Euros per withdrawal

- Foreign Currency Fee: 0 Euro worldwide up to 1,000 Euros per year

- Card Type: Mastercard debit or credit card

- 2.01% p.a. interest on savings account

Conclusion of the bank account comparison

A new bank account can save you a significant amount of money and make your financial life much easier. However, as with most financial products, it is far from easy to navigate the jungle of different providers and find the best checking account.