The American Express Gold Card is available in two different colors – classic gold and rose gold. Best of all, you can apply for it with an Amex Gold Card welcome bonus of 55,000 Membership Rewards® points!

American Express Gold Card

- 180 Euro SIXT Plus and 50 euros SIXT Rent credit

- 80 Euro Lodenfrey credit

- 60 Euro Freenow taxi credit

- Collect valuable points with every euro spent

- Versatile discounts thanks to Amex Offers

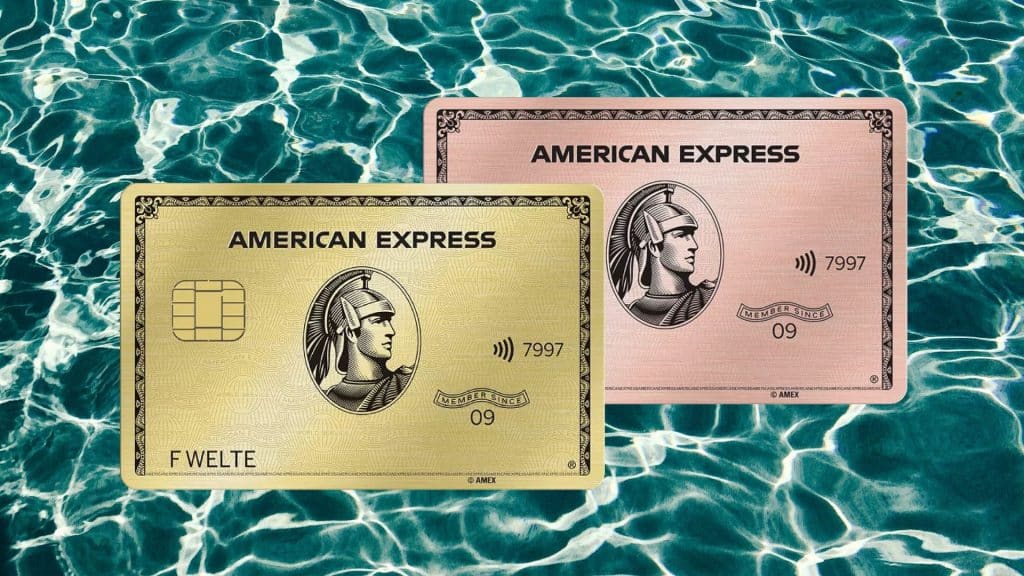

- Choose between gold or rose gold

- Comprehensive travel insurance included

- Hotel status and travel benefits included

Through reisetopia, you can now secure the American Express Gold Card with a welcome offer up to 55,000 points. You can choose whether you want the card in classic gold or in rose gold.

If you apply directly to American Express®, you will only receive a starting balance, which is why the points bonus with a value of over 850 euros is the much more attractive option! You can find all the information you need here.

Inhaltsverzeichnis

All details about the welcome offer for the Amex Gold Card

The Amex Gold Card is an extremely attractive card, especially for those who want to start collecting miles. If you have already planned trips for this year or have major trips coming up next year, now is the best time to apply for the card, as the Amex Gold offer with a 55,000-point welcome bonus makes it very worthwhile.

You will currently receive up to 50,000 welcome points for the classic Gold Card and as many as 55,000 bonus points for the Gold Card Rosé!

American Express Gold Card

- 180 Euro SIXT Plus and 50 euros SIXT Rent credit

- 80 Euro Lodenfrey credit

- 60 Euro Freenow taxi credit

- Collect valuable points with every euro spent

- Versatile discounts thanks to Amex Offers

- Choose between gold or rose gold

- Comprehensive travel insurance included

- Hotel status and travel benefits included

Since last year, the card has been presented in a refined new metal design and offers a wide range of additional benefits. You can also apply for the credit card, which is made of high-quality metal, in another color. You can choose whether you want the card in classic gold or rose gold. It’s definitely worth taking a closer look at the card and applying for it with the Amex Gold Bonus!

Applying for the Amex Gold Card

Applying for the Amex Gold Card is quick and easy with the video identification process. In our step-by-step guide for applying for the Amex Gold, we show you what to do next:

How to Apply for an Amex Gold Card:

- Personal Information: Enter your first and last name, date of birth, place of birth, email, and nationality; the name on the card is automatically filled in to ensure it appears correctly on the credit card.

- Card Type Selection: Choose between the classic Gold Card or the Rose Gold metal version, depending on which appearance you prefer.

- Contact Details: Enter your phone number, your mother’s maiden name for identity verification, your address, and your living situation, including how long you have lived there. You can also choose your communication preferences, which is optional and can be left blank.

- Financial Information: Provide your bank account, IBAN/BIC, SEPA mandate, occupation, net income, and main source of income so your ability to pay can be assessed.

- Review Summary: Check all entered data to correct any mistakes before submitting the application officially.

- Submit Application: Confirm your consent so the application is sent and reviewed by American Express.

- Identification: Complete the verification process via a post office or video ID with your ID document to have the card approved.

You will usually receive your Amex Gold Card in your mailbox in less than 14 days and can start enjoying all the benefits.

How much income do you need for an Amex Gold Card?

We recommend checking the requirements for applying for the Amex Gold if you want to know your chances of successfully obtaining a card.

General requirements for applying for an American Express credit card:

- Creditworthiness: A positive credit score (e.g., SCHUFA) is crucial; negative ratings significantly reduce your chances.

- Income and employment: A steady income and stable job are usually required.

- Bank history: Your relationship and history with the bank can be relevant.

- Financial overview: Banks typically ask for information about your overall financial situation.

There is no official minimum income requirement – even with a lower income, your application can still be successful. More important are a positive SCHUFA credit rating and accurate information about your financial situation. In general, anyone with a steady income and good credit can apply for a credit card. Those with credit issues may consider cards without a credit check.

How to receive the American Express welcome offer

To receive the American Express Gold bonus of up to 55,000 points, you must spend a minimum of 5,000 Euro with the card in the first six months. You can track your current spending on a daily basis in the app, giving you a clear overview of your finances.

You will receive 20,000 points if you spend 3,000 Euro within the first six months of receiving the card. You will receive up to 35,000 additional points once you have spent a total of 5,000 Euro during this period. This is a great way to quickly build up your mileage or points account.

Our tip: Register your Amex Gold Card as your payment method with all online shops as soon as you receive it, and you’ll quickly reach the minimum spending requirement of 5,000 Euro. You can also earn miles with partner cards, so it’s worth getting your family involved.

There are also regular promotions that award extra points for adding an additional card, making it easy to earn even more Membership Rewards® points.

The best part? If you successfully meet the minimum spending requirement of 5,000 Euro and then receive your 55,000 American Express welcome bonus points, you will have a total of almost 62,500 points. This is because the minimum spending requirement already earns you 7,500 points when you activate the Membership Rewards Turbo Program.

💡 The American Express Membership Rewards Turbo Program is an optional upgrade that allows cardholders in Germany to earn 50 percent more points on their everyday spending. For just 15 euros a year, purchases earn 1.5 points per euro instead of the standard 1 point, up to an annual spending limit of 40,000 euros. This means you can collect up to 20,000 additional points each year, making it a simple and cost-effective way to boost your rewards balance.

The advantages of the Amex Gold Card

Beyond the welcome bonus, the Amex Gold Card stands out for its range of valuable benefits. Here’s a brief overview of what the card has to offer.

For example, introduced with the card refresh, the Amex Gold Card includes key insurance covering lost house or car keys, emergency locksmith services, replacement keys and even a new lock if required. The refresh also introduced several additional benefits. Here are our favorites:

- 80 euros in LODENFREY shopping credit per year (2 × 40 euros every six months)

Every six months, you will receive 40 euros that you can use to purchase beautiful traditional clothing or high-quality everyday favorites. To do so, activate the shopping credit once in Amex Offers.

- 5 euros FREENOW taxi credit per month (60 euros per year)

With the FREENOW app, you can book taxi rides throughout Germany and benefit from a monthly discount thanks to the credit.

- 50 euros per year in SIXT rent car credit (2 × 25 euros every six months)

Want to book a rental car for your next adventure? Then you can benefit from the credit, which can be redeemed online using a credit code, for a minimum rental period of three days.

- 15 euros per month in SIXT+ car subscription credit (180 euros per year)

After signing a new SIXT Plus car subscription contract, you can benefit from a monthly discount on your car subscription – particularly worthwhile for anyone who wants to use a car every month without being tied to a rental or purchase contract.

The following additional benefits are also available:

- GHA DISCOVERY Gold status

With GHA DISCOVERY Gold status, you earn one percent more of the hotel’s own currency, D$, per night.

- 20 percent roaming credit on all data packages from eSIMfirst

After activation in Amex Offers and payment with the Amex Gold Card, you will receive a 20 percent credit refund to your card account.

Fly business class by collecting miles

One of the key advantages of the Amex Gold Card is clearly the ability to collect miles. As with most Amex credit cards, you earn one Membership Rewards point on your account for every euro you spend. If you activate the Membership Rewards Points Turbo program, you even earn 1.5 points per euro spent.

The points you collect are extremely valuable because you can transfer them to numerous frequent flyer programs. Transfer partners include British Airways Club and Scandinavian Airlines’ SAS EuroBonus program.

The conversion ratio for some programs is 5:4, meaning that your 55,000 American Express points will earn you a full 44,000 miles.

These naturally have different values depending on the program, but can be extremely valuable when redeemed correctly – this bonus is the first step towards a flight in business class or even first class!

Benefit from Amex Offers with the Amex Gold Card

Amex Offers are another unbeatable advantage of the Amex Gold Card. You can repeatedly benefit from discounts at selected shops or stay at renowned hotels at lower rates.

If you use the Amex Offer wisely, you can pocket several hundred euros a year in refunds on everyday expenses – an opportunity that is absolutely unique among credit cards in Germany.

Comprehensive insurance coverage with the Amex Gold Card

Another attractive feature of the Amex Gold Card promotion is that you receive several types of insurance. The package includes all of the following insurance policies:

- Travel cancellation insurance

- International health insurance (worldwide)

- Travel comfort insurance (coverage for flight or baggage delays and baggage loss)

- Motor vehicle breakdown cover (Europe-wide)

- Luggage insurance

- Transport accident insurance

- Purchase protection insurance in the event of burglary and damage

- Protection in the event of unauthorized use of the card

- Key loss insurance

Can you access airport lounges with the Amex Gold Card?

With the Amex Gold Card, you can purchase the Priority Pass at a reduced price and gain access to over 1,550 airport lounges worldwide. Unlike with the Amex Platinum, membership is not included, but you save up to 35 percent on the regular price, depending on the membership option you choose.

Good to know: There is currently also a bonus available for other Amex credit cards like the Amex Platinum Card.

Amex Gold welcome offer: Our conclusion

The Amex Gold Card with a welcome bonus of up to 55,000 points is well worth considering despite its annual fee of 240 euros. When redeemed wisely, Membership Rewards points can deliver excellent value, while the card itself comes with a range of attractive benefits.

If you don’t currently have the Amex Gold Card, this offer gives you a great opportunity to start earning points and make your next premium flight more affordable.

American Express Gold Card

- 180 Euro SIXT Plus and 50 euros SIXT Rent credit

- 80 Euro Lodenfrey credit

- 60 Euro Freenow taxi credit

- Collect valuable points with every euro spent

- Versatile discounts thanks to Amex Offers

- Choose between gold or rose gold

- Comprehensive travel insurance included

- Hotel status and travel benefits included