American Express® is one of the largest credit card providers worldwide, alongside Visa and Mastercard. As the credit card issuer offers many additional services, the various American Express credit card models are enjoying increasing popularity

Comparison of American Express credit card models

American Express Platinum Card

- Deal: Up to 85.000 points welcome bonus

- 150 euros in restaurant credit

- 200 euros in travel credit

- 200 euros in Sixt Ride credit

- Free lounge access with guest

- The best insurance package in Germany

American Express Gold Card

- Deal: Up to 50.000 welcome bonus points

- SIXT credit: 180 Euro SIXT Plus & 50 Euro Rent

- Credit: 80 Euro Lodenfrey & 50 Euro Freenow

- Earn points with every euro you spend

- Comprehensive travel insurance included

American Express Green Card

- Deal: 10.000 welcome bonus points

- 5 Euro monthly fee

- Free from the second year onwards with a minimum spend

- Collect Membership Rewards with every purchase

- Travel insurances included

American Express Blue Card

- 25 euro starting credit + 5.000 bonus points

- 0 euro annual fee

- Public transport accident insurance included

- Collect Membership Rewards with every euro spent

Payback American Express Credit Card

- Deal: 5.000 points welcome bonus

- No annual fee

- Earn points (miles) with every payment

- Free additional card

But what models are available, and are Amex credit cards really worth it? Are the individual models still attractive despite the annual fee? From fees to travel benefits, our guide provides you with all the information and experiences you need to know about American Express credit cards —including a comparison of the different credit cards.

Inhaltsverzeichnis

- What American Express credit cards are available?

- How does American Express differ from other credit cards?

- What are the advantages of American Express credit cards?

- What are the disadvantages of American Express credit cards?

- Who would benefit from an American Express credit card?

- American Express Credit Cards: Our personal experiences

- What are the alternatives to an American Express card?

- American Express Credit Cards Compared: Our Conclusion

What American Express credit cards are available?

First of all, the question arises as to what exactly lies behind this financial services provider. The American Express Company (Amex) was founded in 1850, has its headquarters in New York City, and mainly offers credit card products.

American Express has also built up a wide-ranging card portfolio on the German market, consisting of credit cards with credit limits for private users, corporate credit cards, and a number of co-branded credit cards, such as the American Express BMW Card and American Express Payback credit card.

The American credit card provider offers several different models that are suitable for different purposes and different people.

The ability to collect miles and points in the American Express Membership Rewards® bonus program is one of the biggest advantages, which makes the credit cards particularly attractive.

Which personal credit cards does American Express offer?

American Express offers a wide range of personal credit cards, which in Germany include the following:

- American Express Blue Card

- American Express Green Card

- American Express Gold Card

- American Express Platinum Card

- American Express Payback credit card (co-branded credit card with Payback bonus program)

- American Express BMW Card (co-branded credit card with fuel discount)

- BMW Premium Card Carbon (co-branded credit card with fuel discount)

There is also the legendary black credit card from Amex, the Centurion Card, which has no credit card limit. There are many rumors about it, but it is only available to a select group of customers and by invitation only. American Express also offers credit cards in Austria and Switzerland (in cooperation with Credit Suisse).

Which business credit cards does American Express offer?

However, American Express does not only offer products for private customers in Germany. If you are interested in an American Express business credit card for freelancers, self-employed persons, and companies, we recommend taking a look at the three American Express business credit cards:

- American Express Business Green Card

- American Express Business Gold Card

- American Express Business Platinum Card

For companies with a turnover of more than ten million euros, there is the American Express Corporate Card.

It is also worth mentioning that, as an American Express cardholder, you can apply for partner cards for friends and family through the American Express card service, some of which offer very attractive benefits.

The exact number of additional cards depends on the respective card model. We explain the exact differences between the cards and for whom they are worthwhile or suitable in more detail below.

How does American Express differ from other credit cards?

They differ from the common Visa and Mastercard credit cards in a number of key ways. The most fundamental difference is probably in the business structure.

While Visa and Mastercard operate purely as payment networks and issue their cards exclusively in cooperation with banks, Amex issues the majority of its cards directly to customers and thus assumes both the payment processing and the credit risk.

Another difference lies in the customer benefits and premium offers. It quickly becomes apparent that American Express credit cards offer significantly more exclusive benefits for cardholders. Although there are also premium credit cards from Visa and Mastercard, such as the HVB Visa Infinite and the Mastercard World Elite, these do not fare quite as well in a direct comparison.

It is not only the sheer number of benefits that is decisive, but also their quality. For example, the Amex Platinum Card offers the best insurance package of any credit card available in Germany.

American Express aims to reach a specific target group with these premium services. Over decades, American Express has established itself as an exclusive lifestyle brand. Its offering is therefore aimed more at customers with certain expectations and higher card spending.

In contrast, Mastercard and Visa cards are aimed at a broader audience, with simple debit cards for everyday payments and higher-value cards for affluent customers.

When shopping online, you should check whether there are any fees for paying with American Express, as these can vary depending on the merchant.

Since American Express is generally associated with very high fees for merchants in Germany, the card’s acceptance suffers as a result. Although Amex acceptance has increased significantly in recent years, Visa and Mastercard are still way ahead in this aspect and offer almost worldwide acceptance.

What are the advantages of American Express credit cards?

It is reasonable to first ask yourself whether an American Express credit card is the right card for you. In general, these cards have the following advantages in common:

Card Benefits Overview:

- Participation in the attractive Membership Rewards program

- Extensive insurance coverage

- Rotating offers through Amex Offers

- Currently consistently high new customer bonuses

Depending on the card model, there are a number of advantages, especially with the higher-priced products. To this end, American Express works with a wide range of partners to offer cardholders greater convenience and benefits when traveling and in everyday life.

Note: The American Express Payback Credit Card is an exception, as it earns points in the Payback rewards program and does not offer any insurance benefits.

One example of this is the cooperation with selected partners such as SIXT. American Express customers in Germany can benefit from discounts on car rentals, hotel bookings, and flights. The same applies to the cooperation with the popular Priority Pass and various hotel chains such as Hilton.

It is also worth taking a detailed look at the numerous benefits, such as insurance and other perks, that are included with most Amex credit card models.

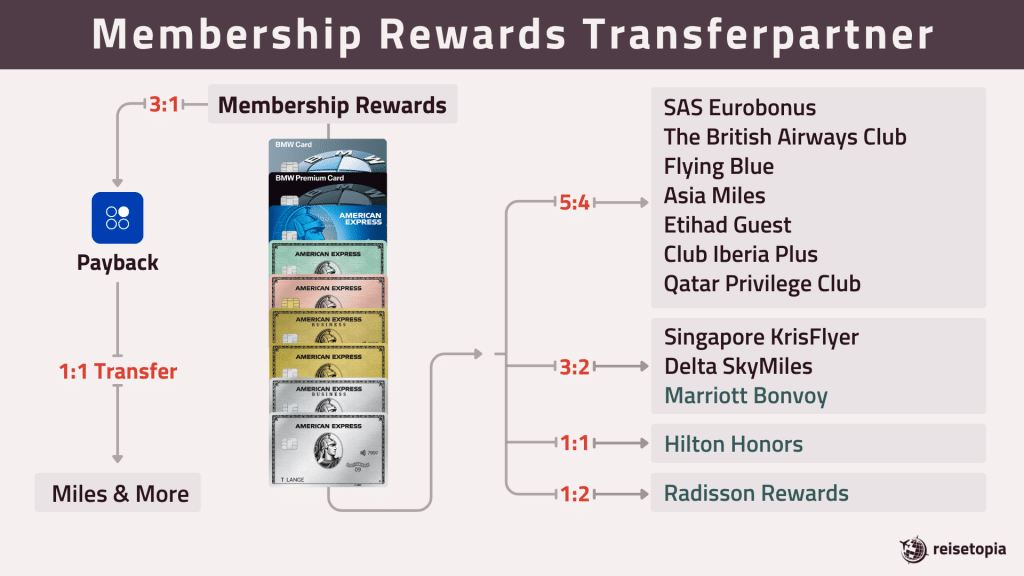

How can I earn miles with American Express credit cards?

When it comes to credit cards for earning miles in Germany, there is hardly a better option than an American Express credit card.

From August 1, 2025, the transfer ratios from Membership Rewards to the Qatar Airways Privilege Club, Cathay Pacific Asia Miles, Etihad Guest, and Emirates Skywards frequent flyer programs will change. You can find all the information about the changes to Membership Rewards in this article.

👉 The following examples refer to the status up to and including July 31, 2025! We are constantly working on updates in the background – as soon as this notice is no longer displayed, the respective article is up to date.

Why? Because these are credit cards with a bonus program, as you can collect one point for every euro you spend in the attractive Membership Rewards program. You can then use these points as follows:

- Booking trips with points

- Transferring points to loyalty programs

- Paying individual credit card charges with points

- Paying the card fee

- Non-cash rewards such as cooking appliances or consumer electronics

- Donations to charitable causes

One of the most attractive options is, of course, transferring points to loyalty programs, as this allows you to collect valuable miles that can be used, for example, to book business or first class flights through various frequent flyer programs.

To fill up your mileage account faster, you can often receive an attractive welcome bonus when you apply for an American Express Card.

Thanks to Membership Rewards points, we have been able to book business and even first class flights with the following airlines:

- British Airways Business Class

- British Airways First Class

- Cathay Pacific Business Class

- Cathay Pacific First Class

- Japan Airlines First Class

- Lufthansa First Class

- Emirates First Class

- Qatar Airways QSuite

- and many more

We have also explained in detail how you can get free flights thanks to the attractive Membership Rewards Program in several guides on Amex rewards.

But that’s not all, because by activating the Membership Rewards Turbo Program, you can even earn 1.5 points for every euro spent and significantly increase your mileage account.

As you can see, American Express credit cards are particularly worthwhile if you want to collect points for your purchases in euros.

In addition, some models offer such a high new customer bonus that you can test the cards for a year and get a good impression of them.

It is important to note, however, that not every American Express credit card participates in the Membership Rewards program.

The following cards participate in the Membership Rewards bonus program:

- American Express Blue Card (for an annual fee of 30 euros)

- American Express Green Card

- American Express Gold Card

- American Express Platinum Card

- American Express BMW Card BMW Premium Card Carbon

- American Express Business Green Card

- American Express Business Gold Card

- American Express Business Platinum Card American Express BMW Credit Card

The Payback co-branded credit card does not participate in the bonus program, but instead allows you to collect Payback points, which can then be exchanged for Miles & More miles.

What insurance coverage do American Express credit cards offer?

Applying for a credit card can also be a good idea if you want to benefit from American Express’s excellent insurance coverage. Not all cards come with an insurance package, but most of them do.

The following American Express credit cards include insurance:

- American Express Blue Card

- American Express Green Card

- American Express Gold Card

- American Express Platinum Card

- American Express Business Green Card

- American Express Business Gold Card

- American Express Business Platinum Card

However, the insurance coverage varies greatly depending on the card model. The following table provides an overview:

| Insurance | Platinum | Gold | Green | Blue |

|---|---|---|---|---|

| Travel Accident Insurance | x | |||

| Trip Interruption Insurance | x | |||

| Trip Cancellation Insurance | x | x | ||

| International Travel Health Insurance (worldwide) | x | x | ||

| Travel Comfort Insurance (protection against flight or baggage delays and loss) | x | x | x | |

| Car Roadside Assistance (Europe-wide) | x | x | ||

| Travel Baggage Insurance | x | x | ||

| International Travel Liability Insurance | x | |||

| Rental Car Comprehensive Insurance | x | |||

| Rental Car Liability Insurance | x | |||

| Transport Accident Insurance | x | x | x | x |

| Purchase Protection Insurance (burglary & damage) | x | x | ||

| 90-day online & offline return policy | x | x | x | |

| Protection against unauthorized card misuse | x | x | x |

Depending on your individual travel needs, you can determine which model is the best American Express credit card for you.

How can I benefit from the Amex Offers of American Express credit cards?

As a holder of American Express credit cards, you can enjoy the often very attractive Amex Offers free of charge, which you can view and activate online or in the Amex app. This allows you to save a lot of money or collect extra American Express Membership Rewards points.

In addition to discounts at supermarkets, gas stations, and online shops, you will also find offers from airlines, hotel chains, and tour operators, some of which will earn you 100 euros cashback or more.

The Amex Offers available in your account depend on your credit card and how you use it.

Furthermore, not every card offers the popular Amex Offers, which is something you should keep a close eye on.

The following cards have Amex Offers:

- American Express Blue Card

- American Express Green Card

- American Express Gold Card

- American Express Platinum Card

- American Express Business Green Card Payback

- American Express Credit Card

- American Express Business Gold Card

- American Express Business Platinum Card

How can I get lounge access with American Express credit cards?

Thanks to a partnership with Priority Pass, holders of certain American Express credit cards have access to up to 1,550 lounges worldwide.

The following cards have a Priority Pass:

- American Express Platinum Card

- American Express Business Platinum Card

The following cards can purchase the Priority Pass at a discount:

- American Express Gold Card

- American Express Business Gold Card

Every American Express Platinum Card cardholder receives Priority Pass upon application. Priority Pass guarantees you, your American Express Platinum Card partner card, and one guest access to all Priority Pass contract lounges worldwide.

That’s already around 1,550 lounges. American Express Gold Card holders can also benefit and receive a discount on Priority Pass membership.

American Express also has its own lounges, known as Centurion Lounges. These are mainly located in the US and Asia, but the first Centurion Lounge in Europe has now opened in London.

American Express also has its own partnerships with lounge providers and airlines. This means that American Express Platinum Card holders can also visit all Plaza Premium lounges and some independent lounges.

If you have a ticket with Lufthansa and its subsidiary airlines, you can also visit the airline’s Business and Senator Lounges at several locations in Germany and worldwide. With a Business Class ticket for a Lufthansa or partner flight, you often even get access to selected Senator Lounges.

American Express also offers all Platinum members worldwide a benefit that is rarely mentioned: There are various fast lanes at airports in Europe and around the world that can be accessed with an Amex Platinum Card.

This benefit actually only applies to Platinum cards from the respective country, but in most cases, these cannot be distinguished from one another simply by showing them.

Fast Lanes are security checks for business and first class passengers, which can be passed through much more quickly and comfortably. However, you do not need a corresponding ticket with your credit card.

What status benefits do American Express credit cards offer?

With selected American Express credit cards, holders also receive membership status at various hotels and car rental companies. This means you can expect attractive benefits at selected hotels:

- Free breakfast for themselves and one companion

- Free room upgrades, subject to availability

- Option of early check-in or late check-out

Car rental companies also offer upgrades to a higher car rental category and preferential service at the rental station. In both cases, however, the main benefit is cheaper member rates, which make a stay or car rental more affordable.

The status benefits you receive depend on the credit card product you have. With the American Express Gold Card, for example, you receive status with SIXT and two other car rental companies.

American Express Platinum Card holders, on the other hand, automatically qualify for status with Hilton, Marriott, Meliá, and Radisson hotels. These are probably the best-known and largest hotel chains, offering accommodation to suit every budget.

From Hampton Inn by Hilton (for business travelers and families) to Conrad (for luxury vacationers), everyone can find the right hotel here. You also automatically qualify for membership status with the car rental companies Avis, Hertz, and Sixt.

The following cards offer status benefits:

- American Express Gold Card (1 status with car rental partners)

- American Express Platinum Card (7 status with car rental and hotel partners)

- American Express Business Gold Card (1 status with car rental partners)

- American Express Business Platinum Card (7 status with car rental and hotel partners)

How can I benefit from Dining & Lifestyle advantages with American Express credit cards?

As an American Express Platinum Card holder in Germany, you can also benefit from other exclusive advantages. For example, American Express offers exclusive deals on business or first class flights and luxury hotels around the world.

With the International Airline Program, you can get affordable deals on business or first class flights with airlines such as British Airways or Emirates. With the Fine Hotels & Resorts Program, you can book various luxury hotels with attractive package deals.

In addition, Amex credit cards offer a number of everyday benefits. So-called Amex Experiences provide access to exclusive events. American Express is available on site at these events. American Express supports various sporting events and other events, granting cardholders exclusive benefits.

You can also use an Amex credit card at concerts and other events. For example, cardholders are granted access to the lounge at the Uber Arena in Berlin, where free drinks are served in a relaxed atmosphere.

You can also benefit from other status advantages, such as a reduced Golf Fee Card International.

The benefits mentioned above apply primarily to the following cards:

- American Express Gold Card

- American Express Platinum Card

- American Express Business Gold Card

- American Express Business Platinum Card

With the American Express Platinum Card, you also receive a 150 euros restaurant credit each year, which you can redeem at countless restaurants throughout Germany. A total of 2,000 restaurants in 20 countries are available, including several upscale Michelin-starred restaurants.

The credit does not have to be redeemed all at once, so you can visit several different restaurants. However, you must use your American Express Platinum Card to pay – not even the supplementary card can be used.

What are the disadvantages of American Express credit cards?

Even though the disadvantages seem very minor and insignificant compared to the advantages, they should not be ignored. The only negative aspect of American Express credit cards is that they always come with a withdrawal fee and a foreign currency fee – the American Express Cash Service is therefore not very convincing. The fees are as follows:

- Foreign currency fee of 2 percent

- Withdrawal fee of 4 percent (minimum 5 euros)

The Amex foreign currency fee in particular can be significant for payments outside the euro zone. You should therefore take American Express’s foreign fees into account when using the card.

In addition, the Gold and Platinum versions of American Express are among the credit cards with the highest annual fees on the German credit card market. However, the services included are unique and can be worth every cent if you know how to use the cards correctly.

Who would benefit from an American Express credit card?

With so many advantages and benefits offered by American Express, it’s easy to lose track. That’s why we’ve taken a closer look at the individual models, especially for private customers, and reveal which Amex card is the best for you!

Who is the free Amex Blue Card suitable for?

The American Express Blue Card, together with the Payback American Express credit card issued by Payback, is the first truly free credit card in the provider’s portfolio. However, there is a catch, because the Membership Rewards program, which we believe is particularly attractive with American Express credit cards, unfortunately comes at a cost with the Blue Card, unlike with the other credit cards.

However, the costs of American Express credit cards vary significantly depending on the card model. The annual fee can be very high for some cards. In return, cardholders receive extensive benefits such as travel insurance, lounge access, and being able to collect Membership Rewards Points. Those who travel regularly or pay a lot with their card can easily offset the costs with the benefits.

If you want to collect Membership Rewards Points with the Amex Blue Card though, you have to pay an annual fee of 30 euros.

Otherwise, the Blue Card unfortunately offers few relevant benefits. Unlike most Amex credit cards, it does not offer comprehensive insurance coverage or any other exceptional services worth mentioning.

The card offers a standard new customer bonus of 5,000 points and a starting balance of 25 euros, while the most important advantage is the Amex Offers program, which is offered free of charge with the Blue Card, as with all other American Express credit cards.

With the right payment behavior, the Offers program can help you achieve substantial savings throughout the year. For example, there are frequent offers for refunds from hotel chains, airlines, and other travel providers.

In addition, offers from fashion retailers and other online stores, as well as brick-and-mortar stores, are available. If you use the program wisely, you can quickly save up to a hundred euros or more per year on your usual purchases, depending on how actively you use the program.

Overall, the American Express Blue Card can be an interesting option if you want a free credit card that still allows you to collect miles and benefit from additional advantages such as Amex Offers. We consider this credit card to be the perfect model, especially for beginners.

American Express Blue Card

- 25 Euro starting credit

- Free credit card – permanently no annual fee

- Earn points with every euro spent

- Attractive discounts through Amex Offers

Who is the Amex Green Card suitable for?

The American Express Green Card, also known as the American Express Card, is something like Amex’s standard credit card. Previously considered very attractive, it is becoming less and less popular. This is because it costs a 60 Euro fee in the first year, while the similar Blue Card is free of charge.

However, the fee for the Green Card is waived in the second year if you spend 9,000 Euro or more. In concrete terms, this means that it is then a free American Express credit card, provided you meet the minimum spending requirement.

In addition, participation in the Membership Rewards program is free with this card, and you can activate the Turbo program for a fee of 15 euros. This allows you to collect 1.5 points for every euro spent, meaning that you can collect another 13,500 Membership Rewards points for the minimum spend of 9,000 euros alone.

Another relevant advantage of the credit card is that you receive basic coverage in the form of an insurance package. This consists of the following types of insurance:

- Travel comfort insurance (including flight delay insurance and baggage delay insurance)

- Transport accident insurance

- Misuse protection when using the card

Compared to a premium version of the American Express credit card, the scope of insurance may not seem particularly extensive, but for a credit card that may be free of charge, the insurance policies are a positive feature.

However, you should bear in mind that, in our opinion, all three important insurance benefits of a credit card are missing. If you want to be really well covered when traveling, you should definitely opt for a credit card with insurance benefits such as the easybank Platinum Double or another American Express credit card.

The disadvantages of the American Express Green Card are also easy to identify: just like the other cards offered by the US provider, these cards come with withdrawal and foreign currency fees.

We therefore strongly recommend that you use an additional credit card without foreign currency fees for payments in other currencies and for withdrawals, such as the completely free TF Bank Mastercard Gold.

TF Bank Mastercard Gold

- Free credit card

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

In our opinion, the American Express Green Card is always a good choice if you need the insurance and spend at least 9,000 Euro per year, but still want to collect valuable points for free flights in business or first class with your credit card.

American Express Green Card

- Earn Membership Rewards points with every purchase

- No annual fee in the 2nd year with €9,000 annual spending

- Exclusive Amex Offers with attractive credits and bonus point benefits

- Free additional card for family members or partners

- Apple Pay und Google Pay Support

Who is the Amex Gold Card suitable for?

The American Express Gold Card is one of American Express’s most popular cards. This is most likely because the credit card offers an interesting combination of relevant insurance policies and attractive Amex Offers, and comes with an annual fee of 144 Euro. This means that the gold credit card can be worthwhile if you use the services correctly.

Just like with the standard American Express credit card, participation in the attractive Membership Rewards program is free of charge. By activating the Turbo program, you also earn 1.5 points for every euro spent, which you can redeem for miles for a flight in business or first class, for example.

Compared to the Green Card, the Gold Card offers many additional insurance benefits:

- Travel Cancellation Insurance

- Worldwide Travel Health Insurance

- Travel Convenience Insurance (protection against flight or baggage delays and lost luggage)

- Vehicle Protection Plan (Europe-wide)

- Accident Insurance for Means of Transport

- Purchase Protection Insurance (for burglary and delays)

- Protection Against Unauthorized Use of the Card

- Cover in the event of unauthorized use of the card

As you can see, you can expect significant additional benefits. The travel cancellation insurance and international health insurance are particularly important. We would also like to see comprehensive rental car insurance included in a very good credit card with insurance benefits, but unfortunately this is only included with the American Express Business Gold Card.

However, the other insurance benefits of the American Express Gold Card are also attractive, especially since you can benefit from the purchase protection insurance even if you are not traveling.

Another interesting feature of the American Express Gold Card is the free Gold status with SIXT, which is appealing to anyone who regularly books rental cars. In addition, you receive the Priority Pass at a discount of up to 35 percent.

Finally, it should be mentioned once again that the credit card fees are comparatively high. As attractive as the Gold Card is in other areas, you should still have an alternative card in your wallet for payments in foreign currencies and withdrawals.

If you have made provisions for this, this American Express credit card can be an excellent choice if you travel a lot. We would recommend this credit card for beginners, but also for experienced users who want to take advantage of insurance and benefit from the current attractive bonus points.

American Express Gold Card

- 180 Euro SIXT Plus and 50 euros SIXT Rent credit

- 80 Euro Lodenfrey credit

- 60 Euro Freenow taxi credit

- Collect valuable points with every euro spent

- Versatile discounts thanks to Amex Offers

- Choose between gold or rose gold

- Comprehensive travel insurance included

- Hotel status and travel benefits included

Who is the American Express Platinum Card best for?

The American Express Platinum Card is something like the ultimate American Express credit card in Germany. This applies not only to the hefty annual fee of 720 Euro, but also to the services it offers. These are unrivalled in Germany.

We even believe that frequent travelers cannot do without the American Express credit card. The question remains: How did we come to this rather strong conclusion? The answer is quite simple, because the decisive advantages of the credit card lie in the area of travel and quickly justify the high costs:

- 200 euros in online travel credit per year for flights, hotels, rental cars, and more

- 150 euros in restaurant credit per year

- 200 euros in SIXT Ride travel credit in the form of eight credits worth 25 euros each

- 100 euros shopping credit per year

- Participation in the American Express Membership Rewards® program

- Lounge access thanks to Priority Pass for the cardholder and additional cardholders, as well as one guest per Priority Pass

- Access to numerous other lounges in the Global Lounge Collection (e.g., Lufthansa or Delta lounges)

- Up to 200 euros discount & priority benefits when booking Condor flights Comprehensive travel insurance package

- Free Platinum Card as a partner card and four additional Gold Cards for family members or friends

- Participation in Amex Offers with attractive deals and discounts

- Free status levels from Hilton, Marriott, Radisson, Meliá, SIXT, Avis, and Hertz

- Discounts with partners such as SIXT or golf providers

- Telephone advice and travel service for bookings and in case of problems

- Use of the Platinum Service & Amex Experiences

- Additional benefits, such as access to the lounge at the Uber Arena or a discounted Golf Fee Card

We have already discussed the Membership Rewards program at length. As with any other American Express credit card, the Platinum Card also offers 1.5 points for every euro spent when you activate Membership Rewards Turbo.

And if you use the new customer bonus wisely, you can justify the high investment for this American Express card on that basis alone.

Generous credit for travel and restaurants

But while Membership Rewards are sometimes the most important factor with every other American Express credit card, there are a number of other aspects that play an important role with the Platinum credit card.

Let’s start with the travel credit, which was only introduced in 2018. This applies to all bookings made via the American Express Travel online platform, so you can book hotels or flights without any extra charges, for example.

If the booking value is at least 200 Euro, you can easily and conveniently apply your travel credit and receive a substantial equivalent value, which significantly reduces the annual fee.

The restaurant credit also justifies the annual fee, as you receive a credit of 150 euros per year. In addition, there has long been a 200 Euro SIXT credit that can be used for limousine services, as well as a 100 Euro shopping credit at Lodenfrey, which provides cash equivalent value.

Priority Pass membership

Another decisive factor, especially for frequent travelers, is certainly the Priority Pass membership. In short, this is the best membership, allowing you to visit numerous lounges throughout the year.

With the American Express Platinum credit card, not only do you, as the primary cardholder, receive the Priority Pass, but so does the person to whom you give the supplementary card.

Thanks to the credit card, you receive two memberships worth 459 Euro each and can enjoy the comfort of an airport lounge before each of your flights in the future – even when traveling with Ryanair, EasyJet, or Eurowings. This makes the American Express Platinum Card one of the best credit cards with lounge access.

Comprehensive insurance & status benefits

With so many other benefits, the card’s comprehensive insurance coverage is almost forgotten:

- Worldwide Travel Health Insurance

- Trip Cancellation Insurance

- Trip Interruption Insurance

- Travel Luggage Insurance

- Rental Car Comprehensive Insurance

- Travel Convenience Insurance (including baggage delay coverage)

- Travel Accident Insurance

- Shop Guarantee for Electronic Devices

- Key loss insurance

These are as comprehensive as they can be. The coverage amounts are high and the scope of benefits really covers everything you might need when traveling.

However, you should bear in mind that there is always a certain excess to pay and that most of the benefits only apply when you use your card, i.e. when you have paid with your American Express Platinum credit card.

One very attractive feature, however, is that the insurance also applies to the holder of the partner card. If you are traveling with children or grandchildren, the insurance benefits also apply to them.

The status benefits that come with an Amex Platinum card are also worth mentioning. Among other things, you receive a status with the following hotel chains and car rental companies:

- Avis (Avis Preferred status)

- Hertz (Hertz Gold Plus Rewards Five Star status)

- SIXT (SIXT Platinum status)

- Hilton (Hilton Honors Gold status)

- Marriott (Marriott Bonvoy Gold status)

- Meliá (Melia Rewards Gold status)

- Radisson (Radisson Rewards Gold status)

Free benefits for additional cardholders

In general, it should be noted once again at this point that all American Express Platinum credit card benefits, with the exception of travel credit, apply not only to the primary cardholder but also to the partner cardholder. You will quickly realize that the 720 euros annual fee only seems enormously high at first glance. If you divide the fee by two and then take another look at the benefits, it quickly becomes clear why all members of the reisetopia team swear by the American Express Platinum Card.

American Express Platinum Card

- 200 Euro travel credit per year for flights, hotels and more

- 200 Euro SIXT Ride credit per year

- Up to 200 Euro discount & Priority benefits for Condor flight bookings

- Exclusive metal credit card

- Collect valuable points with each turnover

- Free platinum partner card with all benefits included

- Best insurance package in Germany

- Free lounge access with a guest at 1.550 lounges worldwide

- Upgrades, breakfast and more status benefits in hotels

As good as the credit card is, there is a catch. Every American Express credit card, including the top-of-the-line model, comes with high fees for withdrawals and foreign currencies—in addition to the rather high card fee.

That’s why we recommend that you choose a card that offers these services completely free of charge in addition to the American Express Platinum Card.

Who are business credit cards suitable for?

If you are a freelancer, self-employed, or have a business, you should take a closer look at American Express business credit cards. These are very similar to regular (private) American Express credit cards, but ultimately differ in a few details. The following differences can be identified:

- Larger number of free additional cards

- Longer interest-free payment period

- partially different benefits with a business focus

While the Green Card is worthwhile for any company that simply wants to collect miles, the Business Gold and Platinum Cards offer truly relevant benefits.

Who benefits from the American Express Business Gold Card?

The American Express Business Gold Card is particularly attractive because it is free of charge in the first year and, in addition to comprehensive insurance, also includes a 100 Euro Dell credit and free use of the Amex Expense Tool. After the first year, the card costs 175 Euro, but it also includes 99 additional cards for the company.

American Express Business Gold Card

- Free credit card in the first year

- 100 Euro credit per year for Dell Technologies

- Additional liquidity through extended payment period

- Earn valuable Membership Rewards points with every euro spent

- Up to 99 free additional cards included

- Travel cancellation insurance

- Travel health insurance (worldwide)

- Travel convenience insurance

Who is the American Express Business Platinum Card suitable for?

The American Express Business Platinum Card proves to be an even more attractive option. Although it comes with a substantial annual fee of 850 Euro, it includes one additional business card as well as two private cards with a variety of benefits. In addition, up to 100 complimentary employee cards can be issued.

The benefits package also includes attractive credits such as a 200 Euro travel credit, a 200 Euro SIXT credit, and access to 1,550 airport lounges worldwide, along with various status levels similar to those offered by the personal Platinum Card.

Other perks include extended insurance coverage, a 200 Euro Dell credit, and free access to the Amex Expense Tool. However, the card does not include the restaurant credit or the shopping credit.

American Express Business Platinum Card

- 200 Euro travel credit per year for flights, hotels, and more

- 200 Euro Dell Technologies credit per year

- Up to 440 Euro Sixt mobility credit (Ride & Plus) per year

- Up to €600 co-working and phone service credit per year

- Digital invoice management: GetMyInvoices membership

- Earn valuable Membership Rewards points with every euro spent

- Up to 99 free business supplementary cards included

- Supplementary card for personal expenses included

- Additional liquidity with up to 58 days delayed billing

- Comprehensive insurance package

- Free lounge access for up to 4 people in 1,550 lounges worldwide

- Upgrades, breakfast, and other status benefits in hotels

In summary, entrepreneurs who want to collect miles and enjoy a range of benefits are well served with the American Express Business Gold Card. With no annual fee in the first year, it’s also an excellent entry-level option. Anyone who values comfort in travel and daily life will be better off with the Business Platinum Card.

Note on flat-rate taxation: When reward points are earned through the use of a company credit card, they legally belong to the company and are recorded as profit. If these points are then redeemed for private purposes, they are considered a taxable benefit in kind and must therefore be declared as a private withdrawal. Because it’s difficult to determine a specific monetary value for the points, taxation can be quite complex. This is where flat-rate taxation comes into play: American Express handles the taxation of business-earned points on a lump-sum basis. This means that Membership Rewards points are automatically taxed by American Express, allowing you to use them privately without any restrictions.

Who is a co-branded credit card suitable for?

Anyone looking for a slightly different type of American Express credit card can opt for one of the BMW Cards or the Payback American Express Card.

While the American Express BMW Cards offer fuel discounts and still participate in the Membership Rewards program, the Payback American Express Card is quite different from the rest of the portfolio.

With the Payback American Express Card, you earn points exclusively within the Payback bonus program. Those who mainly want to collect Miles & More miles and are not interested in other airline programs should consider this card.

Payback points can be transferred to the Miles & More frequent flyer program once a certain number of points has been reached. This allows you to book discounted Business and First Class flights with Lufthansa or other airlines in the Lufthansa Group or Star Alliance.

However, since the changes introduced in 2023, the transfer ratio has become less attractive: instead of two Membership Rewards points, it now takes three to receive one Payback point. As a result, the Payback conversion rate has significantly worsened.

Payback American Express Credit Card

Promo: 5.000 points welcome bonus

- Free credit card with no restrictions

- Earn points/Miles & More miles with every payment

- Combination of Payback card and credit card

- Amex Offers & purchase protection included

- Free additional card

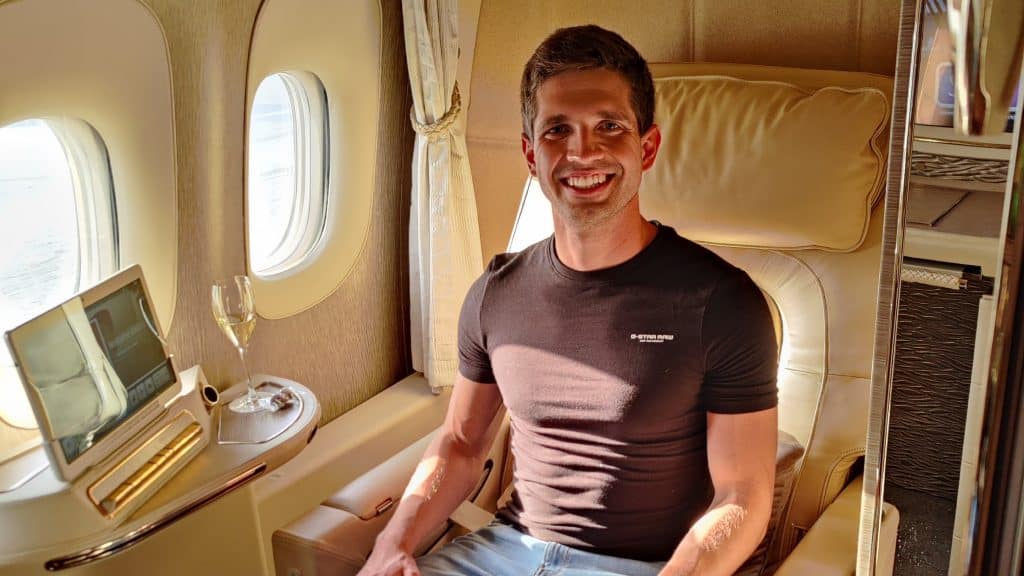

American Express Credit Cards: Our personal experiences

As already mentioned, most of us at reisetopia hold an American Express credit card, and every card model is represented among our team. The American Express Platinum Card is by far the most popular, as it offers maximum comfort and is ideal for earning miles in everyday life as well as for use while traveling.

The numerous credits are also redeemed year after year, allowing us to get the most out of the card — an American Express experience that clearly shows how versatile and rewarding these credit cards can be, both in daily life and when traveling.

We generally use the travel credit for car rentals or hotel bookings, while the dining credit is redeemed around the world, depending on where our travels take us. The complimentary lounge access is also used regularly, as it provides a great deal of comfort and a quiet retreat, especially on business trips.

In addition, most of our employees also hold an American Express Business Card, which makes paying while traveling simple and convenient.

Those who do not have any of the cards mentioned above usually hold an Amex Gold, Green, or Blue Card to collect miles. In particular, Amex Offers are used extensively, as many of the hotel deals can be combined with reisetopia Hotels, creating unique pricing opportunities. For some individuals, this can generate a value of around 500 Euro per person per year.

Overall, our experiences with American Express credit cards have been very positive, and we would recommend them without hesitation. However, it should be noted that acceptance can sometimes be a challenge, as it is significantly lower compared to Visa and Mastercard. For this reason, we always carry a second credit card to offset the occasional limitations of an American Express card.

How widely are American Express cards accepted?

From our experience, the acceptance of American Express cards in Germany has increased significantly in recent years. While Visa and Mastercard remain more widely accepted, you can now use an American Express card at most major supermarkets, gas stations, furniture stores, fashion retailers, and, of course, online.

Almost all airlines, hotels, and travel providers also accept American Express. Acceptance abroad is generally less of an issue than one might think. In the United States, it is almost on par with Visa and Mastercard. Even smaller merchants are increasingly accepting American Express, thanks to payment providers like SumUp.

What Requirements do you need to meet for an American Express Card?

Similar to the question of acceptance, there are also many speculations and rumors surrounding the requirements for an American Express card. From our experience, applying for an Amex card is not as complicated as some might think.

American Express is, alongside Visa and Mastercard, the third major player in the German credit card market. While the two competitors issue significantly more cards, American Express has some unique characteristics. For example, Amex cards are always issued directly by American Express and not through a partner bank. This means there are fewer different Amex cards available, but the cards that do exist typically offer a more comprehensive range of benefits.

As with most credit cards, you must be at least 18 years old to apply for an Amex Card. Contrary to popular belief, the requirements for obtaining an American Express credit card are not significantly higher than those for other credit cards.

Even as students, members of the reisetopia editorial team were able to get approved for the Gold and even the Platinum Card without any issues. If you’d like to learn more about the specific requirements for each card, you can find detailed information in our individual guides.

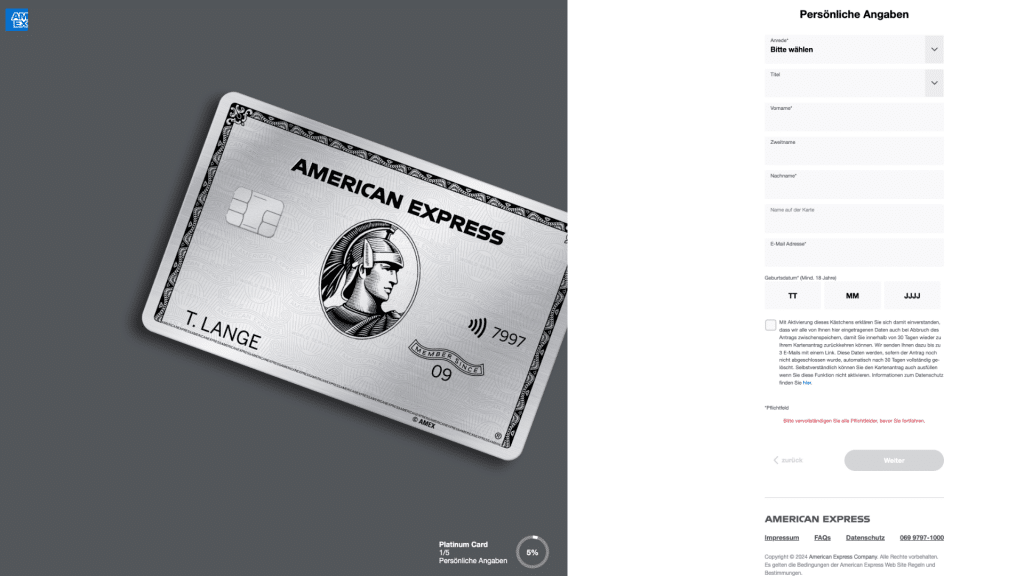

How does the credit card application process with American Express work?

If you’re interested in getting an American Express credit card, you can easily apply through Amex’s digital application process. In our experience, it only takes about 15 minutes. First, you’ll need to provide some personal details and contact information:

- Name and address

- Date of birth

- Postal code

- Email address

- Phone number

Next, you’ll be asked to provide some financial information. This is required, among other things, to determine your credit limit. The following details must be submitted:

- Bank account information (you can view and update your American Express bank details via your online account)

- Current employment status (including monthly income)

- Additional sources of income

Once all the required information has been filled out and reviewed, the final step is to verify your identity. You’ll only need a valid form of identification (passport or national ID card), and you can choose from three different verification methods:

The traditional method of verification is done at a post office. A postal employee confirms your identity, and in addition to your ID document, a PostIdent coupon is required.

A much faster alternative is video identification, which eliminates the need to visit a branch. You only need a working webcam and microphone. Your identity is also verified by a postal employee in this process.

With the PostIdent app, it is possible to turn your mobile device into a card reader. This is made possible via the eID function of your ID document.

How secure is American Express?

Security and trustworthiness are especially important when it comes to financial services—after all, if a credit card is ever lost or stolen, you need to be able to act immediately.

At reisetopia, we generally feel very secure using our American Express credit cards. For one, American Express protects users from unauthorized online transactions through the 3-D Secure process. Internally known as “Safekey,” this feature requires customers to confirm purchases by entering a TAN (sent via email or SMS) or a password in addition to their regular card details.

Furthermore, American Express cardholders are not liable for fraudulent activity on their accounts.

If your American Express card is ever lost or stolen, you can block it immediately via the Amex app or by calling the following customer service number:

+49 69 9797-1000

In most cases, you can expect to receive a free replacement card within three business days. It will be sent to you automatically after the card has been blocked, and your existing PIN will remain valid. For extra security, you can also activate the notification service, which sends you an SMS or email every time your card is used.

What are the alternatives to an American Express card?

While we highly recommend an American Express credit card to anyone who enjoys earning miles and points for their spending, there are also a few drawbacks to consider. The high fees for foreign transactions and cash withdrawals are among the main disadvantages. For this reason, even the reisetopia team relies on additional credit cards alongside their Amex cards.

Travel credit cards

If you want to withdraw cash and make payments abroad without fees, we recommend getting a credit card with no foreign transaction fees and one that allows free ATM withdrawals.

easybank Platinum Double

- Promotion: 50 euro starting credit

- Free cash withdrawals worldwide

- Free payments worldwide

- Extensive insurance coverage

- Free Platinum partner cards

Eurowings Credit Card Premium

- 3,000 welcome miles

- Only 49.50 Euro annual fee the first year

- Free cash withdrawals and payments abroad

- Earn Miles & More miles

If you decide to go with the Amex Blue Card, the easybank Platinum Double is the perfect complement. This premium credit card offers strong travel insurance coverage while still allowing free cash withdrawals and fee-free payments abroad. This way, you can avoid foreign transaction fees, benefit from comprehensive insurance protection, and use the most affordable American Express credit card to earn valuable Membership Rewards points on your euro purchases.

easybank Platinum Double

former Barclays Platinum Double

- Free cash withdrawals worldwide

- Free transactions worldwide

- Free platinum partner card

- Travel cancellation insurance

- Worldwide health insurance

- Rental car insurance

Another great alternative is the Eurowings Credit Card Premium, which lets you earn Miles & More miles even on foreign currency transactions, meaning you get something back for virtually every purchase you make. The best part? The card is free for the first year, so there’s no risk in giving it a try.

Eurowings Premium credit card

- Free cash withdrawals and payments abroad

- Benefits with Eurowings (e.g., Fast Lane, seat reservation)

- Comprehensive insurance coverage

- Earn Miles & More miles

However, there aren’t really any other viable credit card alternatives for earning miles, since the Miles & More Gold Credit Card comes with a similarly high annual fee as the Amex Gold Card and also charges foreign transaction and withdrawal fees.

Free credit cards

If you don’t need an additional travel credit card alongside your American Express, you can take advantage of one of the many free credit cards available on the market. The easybank Credit Card is definitely among the best free travel credit cards. It offers free cash withdrawals and payments worldwide and also stands out for its simple billing process, which is linked directly to your existing checking account—so there’s no need to open a new account.

easybank Visa Credit card

former Barclays Visa

- Free credit card without annual fees

- Free payments worldwide – no foreign transaction fees

- Free cash withdrawals worldwide

- Free loan for up to 2 months

- Flexible repayment options

- Compatible with existing bank account

American Express Credit Cards Compared: Our Conclusion

An American Express card is a great choice for anyone who travels frequently. The downsides lie mainly in the high fees for cash withdrawals and foreign currency transactions. The strengths, on the other hand, are clearly found in the excellent insurance coverage, the highly attractive Membership Rewards program, and last but not least, the extensive additional benefits of the exclusive Platinum Card.

In our opinion, at least one American Express credit card definitely deserves a place in your wallet for everyday points collecting. Depending on your travel habits and annual spending, any of the three models could be the right fit for you. In general, however, you should rely on an additional credit card for cash withdrawals and foreign currency payments.

American Express Platinum Card

- Deal: Up to 85.000 points welcome bonus

- 150 euros in restaurant credit

- 200 euros in travel credit

- 200 euros in Sixt Ride credit

- Free lounge access with guest

- The best insurance package in Germany

American Express Gold Card

- Deal: Up to 50.000 welcome bonus points

- SIXT credit: 180 Euro SIXT Plus & 50 Euro Rent

- Credit: 80 Euro Lodenfrey & 50 Euro Freenow

- Earn points with every euro you spend

- Comprehensive travel insurance included

American Express Green Card

- Deal: 10.000 welcome bonus points

- 5 Euro monthly fee

- Free from the second year onwards with a minimum spend

- Collect Membership Rewards with every purchase

- Travel insurances included

American Express Blue Card

- 25 euro starting credit + 5.000 bonus points

- 0 euro annual fee

- Public transport accident insurance included

- Collect Membership Rewards with every euro spent

Payback American Express Credit Card

- Deal: 5.000 points welcome bonus

- No annual fee

- Earn points (miles) with every payment

- Free additional card