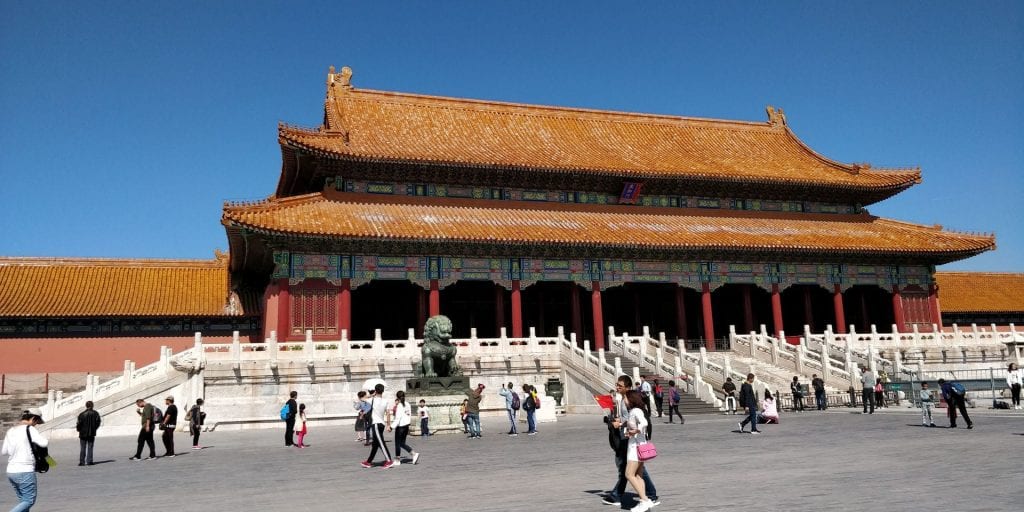

A free credit card is a practical companion for everyday life and travel alike. With no annual fee, complimentary cash withdrawals and additional benefits depending on the provider, the options are diverse. In our guide, we compare the best free credit cards in 2026 and highlight what really matters when choosing one.

The best Free Credit Cards in Germany in comparison

Hanseatic Bank GenialCard

- 0 Euro annual fee

- Free withdrawals abroad*

- Free payments worldwide**

- Repayment in small, flexible installments

easybank Visa

- Promotion: 50 Euro bonus

- Free credit card

- Free cash withdrawals worldwide

- Free payments worldwide

- Free loan up to 2 months

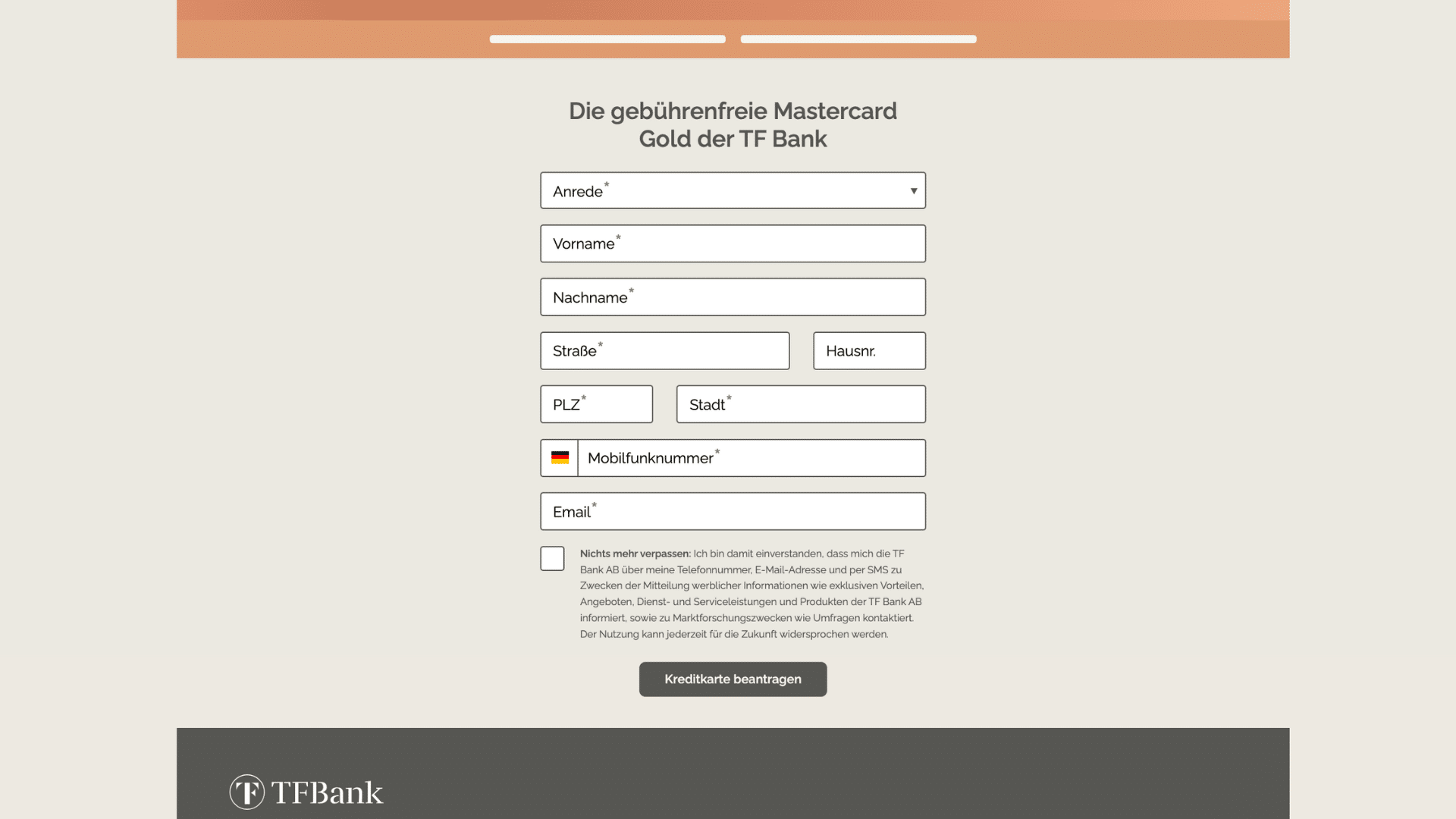

TF Bank Mastercard Gold

- 0 Euro annual fee

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

Bank Norwegian Visa

- Promotion: 15 Euro welcome bonus

- Free credit card – permanently without annual fee

- Free cash withdrawals worldwide

- Worldwide free payments – no foreign transaction fee

- Attractive travel insurance included

awa7 Credit Card

- 0 Euro annual fee

- Pay worldwide free of charge*

- Withdraw cash abroad free of charge**

- Repayment in small and flexible rates

Looking for a free credit card can take quite some time, as the most heavily advertised options are not always the best choice. We believe that finding the right credit card strongly depends on your personal preferences and individual needs.

Free credit cards are among the most attractive financial products in Germany. However, it’s important to consider more than just the absence of an annual fee. In this guide, we take a closer look at the best free credit cards available and show you what to watch out for when choosing the right option.

Inhaltsverzeichnis

- The best Free Credit Cards in Germany in comparison

- What do you need to know about credit cards in Germany?

- Why would you need a free credit card in Germany?

- What’s important when choosing a free credit card in Germany?

- What are the advantages of free credit cards in Germany?

- What aspects do I need to consider before choosing a free credit card?

- Finding the best Free Credit Card in Germany in 2026

- How to apply for a free credit card in Germany

- How can banks afford to issue free credit cards?

- Free Credit Cards in Germany: Our experiences

- How do we get to the experiences about the free credit card?

- When is a free credit card not the right option?

- The best Free Credit Card for Germany: Our Conclusion

- Frequently asked questions about Free Credit Cards in Germany

What do you need to know about credit cards in Germany?

Credit cards in Germany can be quite different compared to other countries. Therefore, before choosing a credit card you want to apply for, it is crucial to understand the market and its implications/facets. To begin with, there are currently four different types of credit cards in Germany.

The different types of credit cards in Germany:

- Prepaid credit card: you can only spend the amount of money you deposit on the card beforehand

- Charge credit card: the amount you spend with the card is accumulated monthly and charged once a month (usually at the beginning or end of a month)

- Revolving credit card: a credit card company issues you a credit that you can either pay back entirely or in installments. If you choose the latter, the outstanding amount will be charged with interest (usually very high fees)

- Debit card: is issued in combination with a bank account, where the amount spent will be charged immediately

Not every type of credit card is suited for all people and their financial needs. Therefore, you should choose a credit card that fits your spending habits and requirements.

💡 Good to know: In general, the German market features a lot of free credit cards that offer the same conditions (or better) than credit cards with a high annual fee!

Why would you need a free credit card in Germany?

A credit card is an essential financial product in Germany, as it can be used for various important payments.

Aside from the fact that you do not have to pay an annual fee, the right free credit card can also help you save money by avoiding fees for payments in foreign currencies or cash withdrawals.

Choosing a free credit card can be the best option if you want to put down a deposit. Some rental car companies and hotels don’t even accept any other payment option than credit cards.

It can be the same for online payments as well, as some retailers only accept this form of payment.

Another reason why you should choose a credit card in Germany is safety. If you lose your card, you can protect it against fraudulent use by calling your credit card company or using an app to block your card immediately.

What’s important when choosing a free credit card in Germany?

The term free credit card generally refers to all credit cards that do not have an annual or monthly fee. Precisely, this means that you do not pay a fee for applying for or holding a credit card.

To ensure that a credit card is free of charge, you must therefore pay attention to the annual fee.

💡 Tip: Some credit cards are only free of charge in the first year but charge annual fees in the following years. It can make sense to use a credit card free of charge in the first year if it offers the corresponding benefits, but then you have to remember to cancel the card in advance or to switch to another model.

👉 In Germany, the TF Bank Mastercard Gold, for example, is advertised as a completely free credit card and offers a lot of benefits for card holders.

TF Bank Mastercard Gold

- Free credit card

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

What are the advantages of free credit cards in Germany?

Credit cards without an annual fee have numerous advantages that make them, in our opinion, the absolute best means of payment that everyone needs in everyday life.

Besides using this card to withdraw money free of charge from any ATM in combination with multiple advantages abroad, there are many other benefits of free credit cards.

Advantages of free credit cards in Germany:

- No additional fees

- Free cash withdrawals worldwide

- Financial flexibility

No additional fees

Paying no additional fees sounds very good, but for some it might sound too good to be true. Indeed, many credit cards include free services in their annual fees.

However, you might not need to pay these annual fees, as there are plenty free options that offer the same free services.

For this reason, if you are still paying unnecessary annual fees for products that are not even half as good as the free options, you should start thinking about applying for a new one immediately. By choosing one of the free credit cards from our comparison, you can save a lot of money long term.

Free cash withdrawals worldwide

Another important aspect of free credit cards is that you can withdraw cash completely free of charge. This does not sound particularly spectacular at first glance, but can be very significant, especially as many establishments in Germany still only accept cash as the only means of payment.

The only restriction is that it must be an ATM that accepts a Visa or Mastercard (depending on which card you choose). However, there are thousands of ATMs in Germany alone that you can use free of charge.

In addition to free withdrawals in Germany, you should also be able to withdraw money abroad free of charge. Credit cards from branch banks usually raise a fee of 5 euros for the service, which can quickly add up.

👉 Credit cards such as the Barclays Visa credit card on the other hand, ensure the Visa rate against the foreign currency, so you have to pay nothing on top.

easybank Visa Credit card

former Barclays Visa

- Free credit card without annual fees

- Free payments worldwide – no foreign transaction fees

- Free cash withdrawals worldwide

- Free loan for up to 2 months

- Flexible repayment options

- Compatible with existing bank account

Finally, when withdrawing money with credit cards, it should be mentioned that many cards also allow you to borrow money from your loan. This way, you can secure cash that, in the best case, you only really need to pay back 60 days later and thus enjoy additional financial flexibility.

Financial flexibility

The last aspect that can make free credit cards very valuable is the financial freedom they can bring. Let’s take the example of the free credit card from Barclays, which lets you borrow money for up to 60 days.

You pay with the credit card and the amount spent is only debited from your account 60 days later.

If necessary, you can also postpone the payment even further into the future by using installment payments.

However, you need to be careful, as this option can also be used unintentionally, resulting in high fees when you actually wanted to pay the full amount. You can read more about this in the paragraph on the risks of free credit cards.

What aspects do I need to consider before choosing a free credit card?

To ensure that a credit card is and remains free, you should not only look at the annual fee. Similar to other financial products, additional costs can also be incurred at one point or another.

Three different fees are usually particularly relevant:

- Withdrawal fee

- Foreign currency fee

- Installment fee

All of the above only apply if you use certain services. Of course, this can be explained quite quickly in the case of the withdrawal fee: This fee is always charged when you use your credit card for a withdrawal.

Although there are many free credit cards that allow free withdrawals, this is by no means the case for all credit cards. Therefore, credit cards from direct banks that offer free withdrawals not only in Germany, but even worldwide, such as the Barclays Visa, are particularly recommendable.

Besides the withdrawal fee, the foreign currency fee may also be an important aspect. Especially if you are looking for a free Visa or free MasterCard when travelling, this fee is of enormous relevance.

When travelling, you usually have to pay an additional fee for payments in other currencies, the so-called foreign currency fee. This usually amounts to between 1 and 2 percent of the respective turnover.

👉 If you have a higher turnover in US dollars, for example, a free credit card without a foreign currency fee is definitely worthwhile. We recommend the Hanseatic Bank GenialCard, which offers free withdrawals, no foreign currency fee and is permanently free.

Hanseatic Bank GenialCard

- 0 euro annual fee

- Free payments worldwide*

- Free cash withdrawals worldwide**

- Repayment in small and flexible installments

The issue of payments is often a bit complicated. With some free credit cards, the benefits sound almost too good to be true. That’s why you should pay attention to the so-called installments.

This is related to the payment of the credit card and can cause relevant costs. In addition to credit cards from direct banks, such as the comdirect credit card or the ING credit card, there are also free American Express credit cards without this fee.

You should be careful with other cards, however, because you may have to pay interest if you don’t pay back your credit immediately. To avoid this, you have to change the payment method to a monthly bank transfer, for example.

💡 Expert Tip: If you choose payment by installments to pay back your credit card expenses, only a certain part of your turnover is actually debited from your account at the end of the month. The rest is left with the bank as credit and is interest-bearing, which can quickly become expensive.

If you keep an eye on the different fees and make sure to choose a permanently free Visa or Mastercard credit card, you will certainly get a good deal with a free credit card. In the next step, we will show you which cards are best suited for you!

Finding the best Free Credit Card in Germany in 2026

If you are looking for the best free credit card, you should definitely not choose a prepaid credit card. Prepaid cards are rarely beneficial, which is why we advise you to go for a regular credit card. You will find the best options if you choose either a free Visa or a free MasterCard.

Which credit card is really the best for you, however, depends very much on your personal preferences and travel behavior, as there is no such thing as the perfect free credit card for every situation. We have compared some of the best free credit cards in Germany below:

Hanseatic Bank GenialCard

- 0 Euro annual fee

- Free withdrawals abroad*

- Free payments worldwide**

- Repayment in small, flexible installments

easybank Visa

- Promotion: 50 Euro bonus

- Free credit card

- Free cash withdrawals worldwide

- Free payments worldwide

- Free loan up to 2 months

TF Bank Mastercard Gold

- 0 Euro annual fee

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

Bank Norwegian Visa

- Promotion: 15 Euro welcome bonus

- Free credit card – permanently without annual fee

- Free cash withdrawals worldwide

- Worldwide free payments – no foreign transaction fee

- Attractive travel insurance included

awa7 Credit Card

- 0 Euro annual fee

- Pay worldwide free of charge*

- Withdraw cash abroad free of charge**

- Repayment in small and flexible rates

For example, if you travel infrequently or only within the euro zone, you do not necessarily have to pay attention to the foreign currency fee. In this case, a credit card can be important for online shopping and sometimes for cash withdrawals. Therefore, in many cases, the free credit cards of direct banks, such as comdirect or ING have attractive offers.

However, in order to use the credit card free of charge, you also have to open a bank account, which is also free of charge. Nevertheless, the credit cards from direct banks are in most cases absolutely recommendable.

If you are not interested in opening another bank account, you can still choose between a number of different options. The Barclays Visa is an excellent example of a free credit card that applies no foreign currency fees. Therefore, it is perfectly suited for travelers.

How to apply for a free credit card in Germany

Applying for a credit card in Germany can be quite complicated. Below, we have listed the various steps for you, on how to apply for a free credit card.

Steps to apply for a credit card:

- Choosing the right credit cards in the credit card comparison

- Applying for a card via the bank’s website

- Identification via Video-Ident, E-Ident or Post-Ident

- Submission of further documents (only in some cases)

- Issuing & sending the credit card

- Activation of the credit card

We have created a guide to lead you through the application process through our website, which shows you what information you need to provide. Generally, the application process of a credit card in Germany should be quite similar to the following examples.

How can banks afford to issue free credit cards?

You may be wondering how a free credit card can be profitable for a bank. After all, you don’t pay any annual fees and you can even get cash without for free, as for example with the ING credit card. The fact that the cards can still be profitable for the banks is due to fees in other areas. Particularly relevant here are these three fees, which you should be aware of:

- Withdrawal fees for cash withdrawals

- Foreign currency fees for payments abroad

- Fees for using the installment facility

We have already briefly touched on these fees in this article. Simultaneously, we have shown you that there are cards that apply no additional fees for withdrawals nor a fee for payments in foreign currencies.

In this case, the banks rely on you using the payment by installment option, which allows the bank to earn a lot of money by charging interest. In most cases, interest rates of between 10 and 20 percent per year are expected. If you were to always use the payment by installment option for an average monthly bill of 1,000 <, you would pay up to 200 euros in interest per year.

We therefore strongly advise against using this payment option. With other free credit cards, on the other hand, you can switch directly to full payment by direct debit after receiving the card to avoid the possible costs.

Of course, the banks also earn money with your turnover, which is why cards such as the American Express Green Card or the Barclays Gold Visa are free of charge from a certain turnover. However, the banks normally only receive fees of a maximum of 0.3 percent of the turnover.

This means that if you transact 10,000 euros a year with your credit card, for example, the bank earns only 30 euros, which is why the banks often try to generate additional income with fees by charging interest for outstanding payments – you should therefore be particularly careful.

What risks can free credit cards entail?

We advise you to look out for hidden costs on free credit cards. If you choose a credit card without an annual fee, you should make sure that the card is permanently free and not just in the first year. This is the case with the American Express Gold Card, for example.

A credit card with a high annual fee from the second year onwards can be a real cost trap, which is why you should be careful. Ideally, you should choose a credit card that can be used for a long time without an annual fee.

❗Attention: Many online comparisons often talk about free credit cards, even if they are only free for the first year. In this case, you will have to pay for the second year or even change credit cards again. If you want to avoid this, it is better to use a suitable model that is permanently free of charge.

Apart from that, the cost traps with free credit cards can primarily occur in the areas mentioned above. Depending on the card model, cash withdrawals can be comparatively expensive, and payments in foreign currencies can also be costly.

You should also avoid using the payment by installment option, which usually applies a high interest rate. Especially if you cannot rely on a full repayment option by direct debit, you have to be careful to pay the bill on time every month if you want avoid additional costs.

To avoid the cost traps of free credit cards, we advise you to use credit cards from direct banks. With cards like the N26 credit card, you avoid most additional costs and use a free credit card without major restrictions. Due to the simple application process, this card is also perfectly suited as a credit card for asylum applicants.

N26 MasterCard

- Permanently without annual fee

- Free payments worldwide

- Free cash withdrawals in the Euro-zone

- Free bank account included

Free Credit Cards in Germany: Our experiences

Our team of finance experts has been using various free credit cards for several years, so we can share some experience with you when choosing the right cards. Almost all of us use a free bank account as well as a free credit card, including Hanseatic Bank, TF Bank and Barclays. All recommendations for the best free credit cards in 2026 have been carefully curated and tested by us.

Hanseatic Bank GenialCard

- 0 Euro annual fee

- Free withdrawals abroad*

- Free payments worldwide**

- Repayment in small, flexible installments

easybank Visa

- Promotion: 50 Euro bonus

- Free credit card

- Free cash withdrawals worldwide

- Free payments worldwide

- Free loan up to 2 months

TF Bank Mastercard Gold

- 0 Euro annual fee

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

Bank Norwegian Visa

- Promotion: 15 Euro welcome bonus

- Free credit card – permanently without annual fee

- Free cash withdrawals worldwide

- Worldwide free payments – no foreign transaction fee

- Attractive travel insurance included

awa7 Credit Card

- 0 Euro annual fee

- Pay worldwide free of charge*

- Withdraw cash abroad free of charge**

- Repayment in small and flexible rates

How do we get to the experiences about the free credit card?

The reisetopia team, consisting of around 30 dedicated employees, has worked intensively on all aspects of the free credit cards. We have extensive knowledge of credit card offers and regularly carry out tests to present you with detailed comparisons in our credit card comparison. The financial products are thoroughly reviewed several times a year and the information on existing offers is updated accordingly.

During the evaluation, we pay particular attention to certain criteria, including the fees charged, the billing method and the additional services provided by the bank.

Our experts use their years of experience to determine which credit cards are best suited to our customers based on these criteria. We transparently present the advantages and disadvantages of each card to provide you with a sound basis for your decision.

We pay particular attention to the added value for the customer. We want to ensure that the recommended credit cards not only meet the needs, but also offer additional benefits for our customers.

When is a free credit card not the right option?

While free credit cards are often a very good choice for travel and also for purchases on the internet, you should not always opt for a free credit card. In some cases, a premium credit card may be a better option.

This applies to two types of credit cards in particular:

- Credit cards to collect miles

- Credit cards with insurance benefits

When are these options a better choice than a credit card with no annual fee? The answer is: whenever you travel a lot or you simply achieve high turnovers with a credit card. For example, you can participate in the lucrative Membership Rewards Programme with American Express credit cards and collect 1.5 points for every euro spent.

With a turnover of 10,000 euros per year, you can earn 15,000 points and receive rewards worth up to 300 euros, provided you use the points for flights.

The insurance benefits of credit cards can also be very important. They promise extensive savings, especially for frequent travelers. While a free credit card, for example, saves the annual fee, a somewhat more expensive premium credit card can be beneficial because of the insurance.

With the Barclays Platinum Double, for example, an annual fee of only 99 euros includes travel health insurance, travel cancellation insurance, and comprehensive rental car insurance.

easybank Platinum Double

former Barclays Platinum Double

- Free cash withdrawals worldwide

- Free transactions worldwide

- Free platinum partner card

- Travel cancellation insurance

- Worldwide health insurance

- Rental car insurance

All these insurances usually cost several hundred euros per year when applied for separately, which is why a credit card with insurance can be a much better choice than a free credit card in some instances. This also applies to the combination of a card with insurance and a card for collecting miles if you have high turnovers. A good example is the American Express Platinum Card. With an annual fee of 720 euros, it is a lot more expensive than a free credit card, but still beneficial with the right travel behaviour!

American Express Platinum Card

- 200 Euro travel credit per year for flights, hotels and more

- 200 Euro SIXT Ride credit per year

- Up to 200 Euro discount & Priority benefits for Condor flight bookings

- Exclusive metal credit card

- Collect valuable points with each turnover

- Free platinum partner card with all benefits included

- Best insurance package in Germany

- Free lounge access with a guest at 1.550 lounges worldwide

- Upgrades, breakfast and more status benefits in hotels

The best Free Credit Card for Germany: Our Conclusion

We are certain that there is a perfect credit card for everyone. However, there are a lot to choose from, which is why you should definitely focus on the best cards in each category. A free credit card should, for example, offer at least free withdrawals, while no foreign currency fee is another advantage.

In general, switching to a free credit card is always a good choice. If you also follow the tips from our credit card comparison, you will undoubtedly find a credit card with no annual fee that suits your needs. However, you should also consider that a premium credit card can sometimes be even more beneficial!

Hanseatic Bank GenialCard

- 0 Euro annual fee

- Free withdrawals abroad*

- Free payments worldwide**

- Repayment in small, flexible installments

easybank Visa

- Promotion: 50 Euro bonus

- Free credit card

- Free cash withdrawals worldwide

- Free payments worldwide

- Free loan up to 2 months

TF Bank Mastercard Gold

- 0 Euro annual fee

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

Bank Norwegian Visa

- Promotion: 15 Euro welcome bonus

- Free credit card – permanently without annual fee

- Free cash withdrawals worldwide

- Worldwide free payments – no foreign transaction fee

- Attractive travel insurance included

awa7 Credit Card

- 0 Euro annual fee

- Pay worldwide free of charge*

- Withdraw cash abroad free of charge**

- Repayment in small and flexible rates

Frequently asked questions about Free Credit Cards in Germany

Are there any permanently free credit cards in Germany?

Yes, there are a lot of credit cards that are completely free. In addition, these cards also offer a variety of benefits, so it is worth comparing the different options.

What are the requirements for Free Credit Cards in Germany?

One requirement for such a card is that you have a good credit rating, as you need to provide information from the SCHUFA to apply for a free credit card in Germany. However, the requirements for some models are not quite as strict, so that you have a good chance even with mediocre SCHUFA-Score.”

Which is the best Free Credit Card in Germany?

It’s hard to say, as there are different aspects you should prioritize depending on your credit card requirements. However, for travelling, the Barclays Visa credit card is definitely one of the best options.

Is a Credit Card Free if there’s no annual fee?

Just because a credit card has no annual fee does not mean that you won’t have to pay to use the card. You potentially will have to pay other fees, for example when you want to withdraw cash or pay in foreign currencies. If you carry a balance, you might also need to pay interest. Overall, look out for the terms and conditions before applying for a credit card.