With so many credit cards available today, it’s easy to lose track. Not only do the individual card types differ significantly in their terms and benefits, but the German market also offers a wide range of rewards credit cards designed for different needs and purposes.

The best credit cards with rewards programs compared

American Express Platinum Card

- Deal: Up to 85.000 points welcome bonus

- 150 euros in restaurant credit

- 200 euros in travel credit

- 200 euros in Sixt Ride credit

- Free lounge access with guest

- The best insurance package in Germany

Eurowings Kreditkarte Premium

- 3,000 welcome miles

- Only 49.50 Euro annual fee the first year

- Free cash withdrawals and payments abroad

- Earn Miles & More miles

Revolut Ultra

- Deal: 10 Euro welcome bonus

- Earn 1 RevPoint for every euro spent

- Unlimited lounge access included

- Free cash withdrawals and payments abroad

- Premium app-subscriptions worth over 1.000 Euro

Hilton Credit Card

- 6.000 welcome bonus points

- Free Hilton Gold status included

- Comprehensive travel insurance included

- Free payments abroad

American Express Rosé Gold Card

- Deal: Up to 50.000 welcome bonus points

- SIXT credit: €180 SIXT Plus & €50 Rent

- Credit: 80 euro Lodenfrey & 50 euro Freenow

- Collect points with every euro spent

- Full insurance protection included

A credit card can make everyday life significantly easier thanks to various features. But the functions are often not the only advantage: to stand out from the competition, some providers implement attractive rewards programs that give cardholders access to additional benefits.

💡 Particularly advantageous are credit cards for collecting miles and points, allowing you to save a considerable amount of money in the long run.

Inhaltsverzeichnis

Whether it’s earning Payback points while shopping or collecting miles for travel benefits – we take a look at credit cards with promising rewards programs and show you which ones are especially worthwhile!

What defines a rewards credit card?

With increasing competition in the financial market, credit card providers are trying more and more to stand out from the crowd. There are various ways to attract attention, whether through low fees, advantageous additional services, or programs that promise different rewards and benefits. Normally, credit card providers offer attractive terms and then try to justify them with an annual fee.

However, there are also free credit cards that often offer the same (if not even better) benefits. Some credit card providers instead focus on attractive programs that allow consumers to earn additional perks.

This naturally encourages more frequent use of the credit card and can be a deciding factor when applying.

This type of credit card is usually issued in connection with major brands from various service sectors. Popular examples include Payback and Lufthansa.

The issuers hope to appeal to specific customer groups and potentially earn additional income through interest charges.

However, many of these bonus program credit cards also charge a higher annual fee. Therefore, such a credit card model is only worthwhile if the benefits are actually used and the money saved justifies the fees.

Accordingly, when searching for the right credit card, you must also ask yourself which bonus program best fits your individual financial behavior.

A credit card with a bonus program is of little use if you can rarely or never take advantage of the benefits. In the worst case, you pay a relatively high annual fee without benefiting from the services.

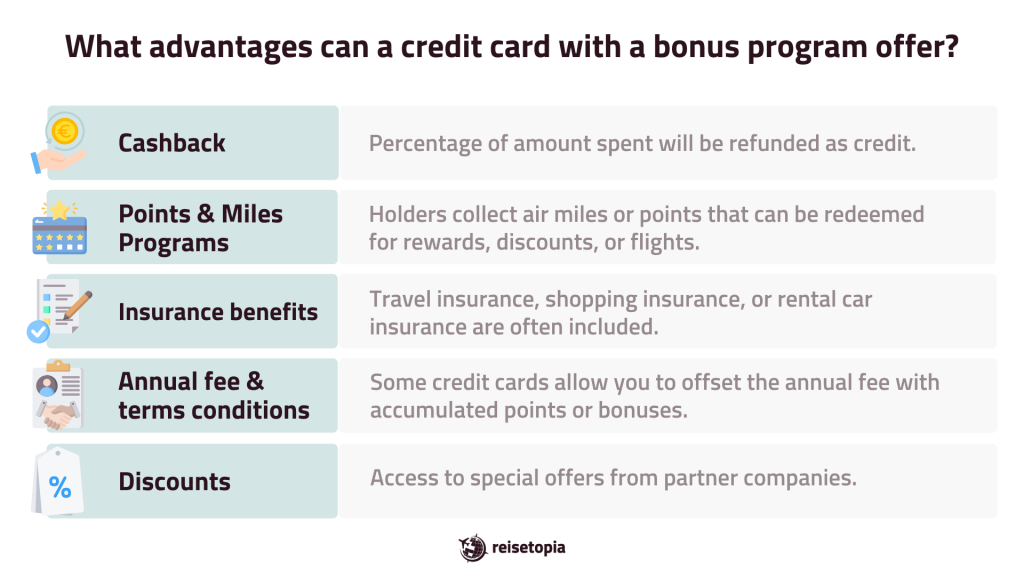

There are different areas in which bonus programs are offered. For example, you can save on purchases in retail stores or online, or secure various benefits when traveling.

Rewards consist of the following benefits that can be claimed in the individual programs:

- Cashback

- Reward points

- Miles

- Insurance

- Discounts

In Germany, cashback is a particularly well-known bonus program, because you receive credits for online purchases. Unlike Payback, you do not need to collect a certain number of points before receiving the reward—consumers usually receive it directly.

Many credit cards also offer various discounts that you can redeem with participating partners. An example of this are different credit cards that provide fuel discounts.

Other credit card models attract customers with various insurance packages, as is the case with the TF Bank Mastercard Gold, for example. With this credit card, you can rely on the following insurance benefits:

- Foreign travel health insurance

- Trip cancellation insurance

- Trip interruption insurance

- Flight delay and baggage insurance

- Personal liability insurance

- Accident insurance

However, in order to take advantage of these benefits, you must have paid for at least 50 percent of the transportation services with the TF Bank Mastercard Gold itself.

TF Bank Mastercard Gold

- Free credit card

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

Other premium credit cards, on the other hand, include insurance benefits unconditionally and are therefore particularly suitable as travel credit cards.

Credit cards with bonus programs: points and miles

Another aspect of bonus programs is miles and points, which particularly benefit frequent travelers. Miles can be used to secure various rewards, such as First Class flights.

In Germany, there are some relevant providers of this type of credit card, such as the Eurowings Premium Credit Card. These allow you to earn a certain number of miles for each transaction, which are then credited to your mileage account.

Another provider is American Express®. With such a credit card, you cannot earn miles directly, but you receive points that can be converted into miles.

The points in the Membership Rewards® program, as the provider’s bonus program is called, can also be used for various services:

- Paying off individual credit card charges with points

- Physical rewards such as kitchen appliances or consumer electronics

- Booking travel using points

- Point transfers

- Paying the card’s annual fee

- Donations to charitable causes

With this type of credit card featuring a bonus program, you usually receive not only miles or points for each transaction but also a certain number as a welcome bonus. Depending on the credit card model, this bonus may be higher or lower.

What requirements must be met for a bonus program?

To apply for a credit card, certain requirements typically need to be fulfilled. Applying for credit cards that work purely on a prepaid basis is generally quick and straightforward.

In contrast, banks issuing credit cards with a credit limit require information about the applicant’s creditworthiness.

Unlike credit cards without a Schufa check, you must demonstrate good creditworthiness here. With negative Schufa entries, the chances of obtaining a credit card are lower. Additionally, in most cases, you must be over 18 years old to receive a credit card.

Some credit card providers, such as American Express, may also waive the annual fee for certain credit card models under certain conditions. The Amex Gold Card offers various benefits that can be particularly advantageous for you when traveling abroad. So it’s definitely worth taking a closer look at the card!

American Express Gold Card

- 180 Euro SIXT Plus and 50 euros SIXT Rent credit

- 80 Euro Lodenfrey credit

- 60 Euro Freenow taxi credit

- Collect valuable points with every euro spent

- Versatile discounts thanks to Amex Offers

- Choose between gold or rose gold

- Comprehensive travel insurance included

- Hotel status and travel benefits included

Which is the best credit card with a bonus program?

When comparing individual credit cards, you quickly realize that the various bonus programs can offer different advantages. Therefore, it’s important to differentiate between the programs, as not all benefits are relevant for everyone.

You should only apply for a credit card with a bonus program if the benefits are useful to you personally and the card itself offers favorable conditions.

Cashback

This type of bonus program is especially popular because, unlike other programs, you usually receive credit directly. This means you do not have to reach a certain spending threshold before receiving a reward. One of the best cashback credit cards is the Targobank Gold Credit Card, as it offers a 1 percent refund on all purchases.

Targobank Credit Card Gold

- Free cash withdrawals worldwide

- 1 percent cashback on all purchases

- Purchase protection insurance for all purchases

- 5 percent discount at Urlaubsplus GmbH

However, the Amazon credit card is also worth highlighting here, as it is free with a Prime membership and also offers an attractive bonus program.

Amazon Visa Kreditkarte

- Free credit card with no annual fee

- Earn Amazon points on every purchase at Amazon.de

- 0.5% cashback on all purchases & 1% cashback on Amazon.de

- 0% interest on Amazon installment purchases with a 3 month term

- Optional travel insurance available as an add-on

The Trade Republic credit card is also a great option if you are looking for a credit card with a cashback program. You also benefit from free payments and cash withdrawals worldwide.

Trade Republic Classic Card

- Free debit card with no annual fee

- Free payments worldwide with no foreign transaction fees

- Free cash withdrawals worldwide (from €100)

- 1% cashback with the Saveback feature

- Interest on credit balances

- Low-cost trades with the linked securities account

Collecting Payback Points

This type of bonus program is perhaps the best-known way to gain benefits through a credit card. With a Payback credit card, you can collect valuable points with every purchase.

In addition to the Visa Flex+, there is also the American Express Payback credit card, and both models are completely free. However, the latter is significantly more advantageous in terms of the point collection rate.

Payback American Express Credit Card

Promo: 5.000 points welcome bonus

- Free credit card with no restrictions

- Earn points/Miles & More miles with every payment

- Combination of Payback card and credit card

- Amex Offers & purchase protection included

- Free additional card

The Amex Payback credit card also offers the option to convert Payback points into the Membership Rewards program of American Express to collect valuable miles.

Collecting miles and points

In Germany, there are also several credit card models that allow you to collect points and miles. The most relevant options are the Eurowings credit card, the American Express credit card models, and the Miles & More credit card. Which one is ultimately more worthwhile can only be estimated based on individual travel habits.

The Eurowings Premium credit card stands out from the competition mainly due to its favorable conditions abroad. With the Eurowings credit card, you can not only collect miles but also make payments and withdraw cash abroad for free. As a credit card for traveling, this model is therefore a valuable companion.

Eurowings Premium credit card

- Free cash withdrawals and payments abroad

- Benefits with Eurowings (e.g., Fast Lane, seat reservation)

- Comprehensive insurance coverage

- Earn Miles & More miles

Similarly, the Lufthansa Miles & More credit card is naturally suitable for collecting miles, especially since the miles are valid indefinitely. However, higher fees apply when using it abroad, which is why it is not recommended for this purpose.

Lufthansa Miles and More Credit Card Gold

- Unlimited validity of Miles and More miles

- Earn miles with every purchase

- Travel cancellation insurance

- International health insurance

- Marriott Bonvoy Silver Elite status

- NEW: Free data allowance abroad

- NEW: Two free cash withdrawals abroad per year

American Express credit cards are particularly well-suited for collecting miles thanks to the Turbo program. The points you earn from credit card spending can be converted into miles and used with numerous frequent flyer programs. In addition, the American Express Platinum card, in particular, offers a comprehensive insurance package, complemented by a variety of discounts.

American Express Platinum Card

- 200 Euro travel credit per year for flights, hotels and more

- 200 Euro SIXT Ride credit per year

- Up to 200 Euro discount & Priority benefits for Condor flight bookings

- Exclusive metal credit card

- Collect valuable points with each turnover

- Free platinum partner card with all benefits included

- Best insurance package in Germany

- Free lounge access with a guest at 1.550 lounges worldwide

- Upgrades, breakfast and more status benefits in hotels

Due to these advantages, no credit card is better for collecting miles than a model from Amex. The American Express Business credit cards alone allow you to earn even more points per transaction. However, before applying for any credit card, the pros and cons should always be carefully considered to determine whether it is worthwhile.

Is a rewards credit card worth it?

Of course, rewards credit cards can seem very appealing at first. After all, who wouldn’t want to earn valuable points on the side? However, before applying for such a credit card, it’s important to understand certain aspects. It’s clear that the issuing banks also aim to profit from their product.

A good credit card is not defined solely by a strong bonus program, as many multifaceted aspects must also be considered. First and foremost is the annual fee. A high annual fee should come with various benefits, such as comprehensive insurance packages with premium credit cards.

If the credit card does not provide any special advantages, it is better to choose a free credit card, as there are models that offer the same benefits without an annual fee. However, caution is advised with these models, as the lack of a base fee may be compensated elsewhere. The following fees should always be considered when choosing the ideal credit card:

- Annual fee

- Fees for cash withdrawals/deposits

- Foreign currency fees

- Possible interest charges

These fees are not equally relevant for everyone, as different needs require different services. For example, if you frequently handle cash, you should choose a credit card that allows free cash withdrawals.

If you travel abroad often, a credit card without foreign currency fees is the right choice. Also, if you want access to a credit line, you should carefully check the interest rates, as high costs may occur with the installment payment option.

Good to know: To profit from a credit card with a bonus program, issuing banks often use different strategies. For instance, a free credit card may charge an annual fee after the first year or if a certain annual spending threshold is not met.

Additionally, high interest rates can apply with the installment payment option if the credit card balance is not fully repaid. Therefore, the terms and conditions should be carefully reviewed before applying to avoid additional costs.

Our conclusion on rewards credit cards

A rewards credit card can be very attractive depending on its benefits and can save a significant amount of money over time. Depending on its intended use, such a credit card can be an excellent choice. However, there are other aspects that are important for selecting the right credit card.

You should not only consider the bonus program but also pay close attention to terms and conditions such as fees and interest rates. Only when these features are favorable can a credit card truly be considered advantageous. It can therefore also be worthwhile to have more than one credit card in your wallet, as there is actually no set limit on how many credit cards you can have.

American Express Platinum Card

- Deal: Up to 85.000 points welcome bonus

- 150 euros in restaurant credit

- 200 euros in travel credit

- 200 euros in Sixt Ride credit

- Free lounge access with guest

- The best insurance package in Germany

Eurowings Kreditkarte Premium

- 3,000 welcome miles

- Only 49.50 Euro annual fee the first year

- Free cash withdrawals and payments abroad

- Earn Miles & More miles

Revolut Ultra

- Deal: 10 Euro welcome bonus

- Earn 1 RevPoint for every euro spent

- Unlimited lounge access included

- Free cash withdrawals and payments abroad

- Premium app-subscriptions worth over 1.000 Euro

Hilton Credit Card

- 6.000 welcome bonus points

- Free Hilton Gold status included

- Comprehensive travel insurance included

- Free payments abroad

American Express Rosé Gold Card

- Deal: Up to 50.000 welcome bonus points

- SIXT credit: €180 SIXT Plus & €50 Rent

- Credit: 80 euro Lodenfrey & 50 euro Freenow

- Collect points with every euro spent

- Full insurance protection included