Wise is a popular payment service provider that enables low-cost international transfers. As a complement to this service, the company offers a debit card under the name Wise Card. But what does the credit card offer, and where do its strengths and weaknesses lie?

Wise Debit Mastercard

- Free digital debit Mastercard included

- Withdraw up to 200 Euro per month free of charge

- Pay in local currencies at live exchange rates

- No Schufa check required

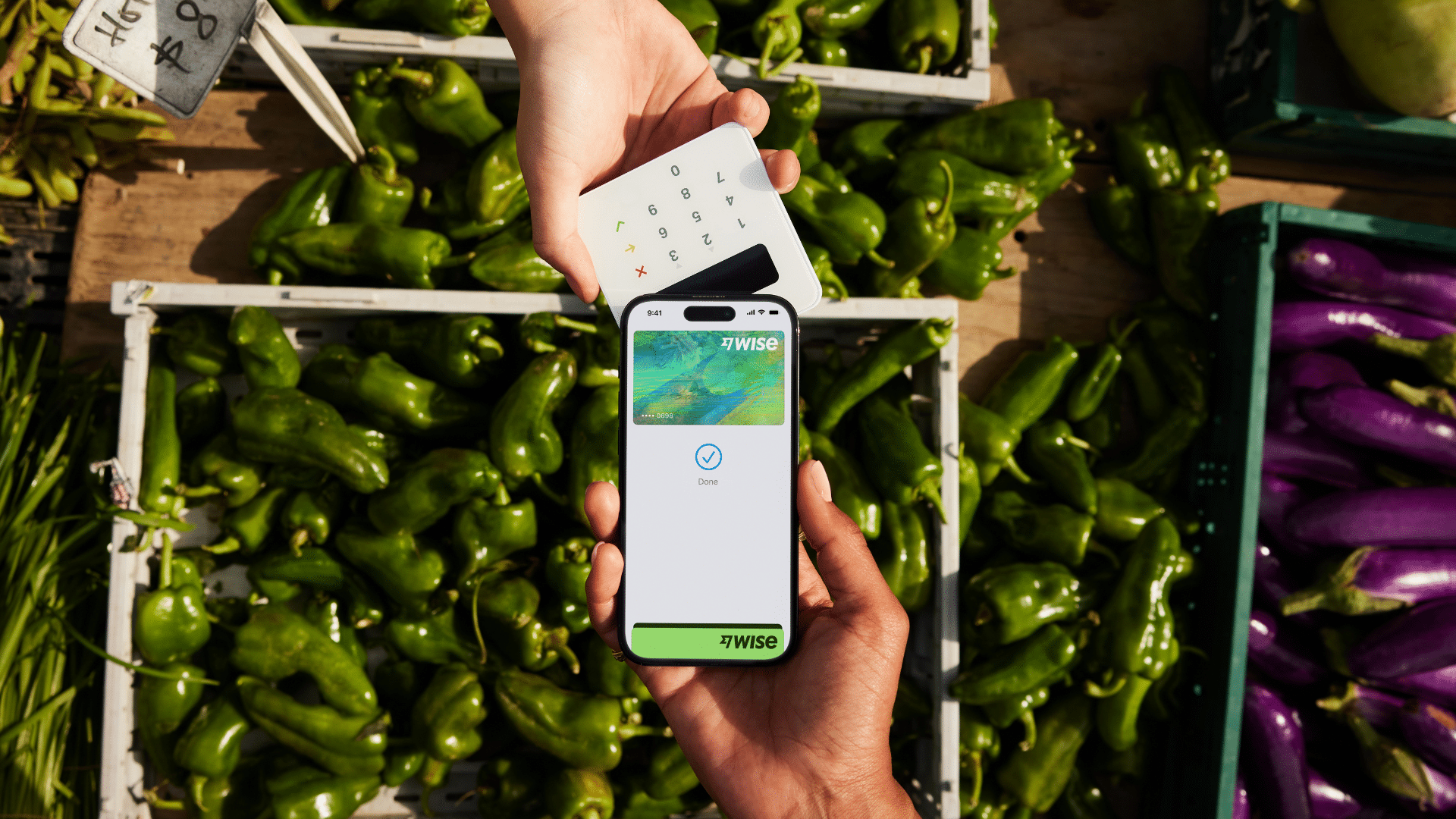

- Apple Pay and Google Pay compatible

Foreign currency fees and poor exchange rates are probably two of the most common issues frequent travelers face. Wise promises to minimize these kinds of charges thanks to its multi-currency accounts. But does that make the Wise Card the perfect travel credit card for payments and cash withdrawals at home and abroad – or are there still some pitfalls? We’ve summarized all the advantages and disadvantages of the virtual card for you.

Inhaltsverzeichnis

- Which bank is behind the Wise Card credit card?

- What are the advantages of the Wise Card?

- What are the disadvantages of the Wise Card?

- How can you apply for the Wise Card credit card?

- Who is the Wise Mastercard suitable for?

- What are the experiences with the Wise Card credit card?

- What are the alternatives to the Wise Card credit card?

- Our conclusion on the Wise Card credit card

Which bank is behind the Wise Card credit card?

The Wise Mastercard is issued by the British fintech company Wise, formerly known as TransferWise. Founded in 2010 and headquartered in London, the company is not a bank in the traditional sense but a service provider focused on international money transfers. Instead of holding a banking license, Wise relies on a peer-to-peer model with local accounts in different countries.

This is a network model in which computers or devices act as equal peers and communicate directly with each other without relying on central servers. In this way, the company is able to keep costs as low as possible while offering competitive exchange rates.

The Wise Card is only an optional add-on offered by the company. Most of the services – such as making international transfers and holding multi-currency accounts – are also available without the card. You only need the card if you want to make payments with the money in your Wise account or withdraw cash.

Even though Wise is not a bank in the strict sense, its services – used by more than 15 million customers worldwide – are regulated by the National Bank of Belgium. So, when it comes to safety and reliability, you don’t need to worry.

However, it’s important to note that your funds with Wise are not protected by deposit insurance, as would be the case with traditional banks. This is because, as mentioned, Wise is not a licensed credit institution. Therefore, there is a certain risk if the company were ever to file for insolvency.

💡 Note: Contrary to popular belief, there is no Europe-wide deposit insurance. Instead, each country operates its own scheme under harmonized EU rules, which guarantees coverage of up to 100,000 euros per depositor in every EU state. However, the actual security also depends on the financial stability of the respective country providing the guarantee.

What are the advantages of the Wise Card?

Wise makes it easy to manage a multi-currency account, and with the Wise Mastercard, the benefits of this account are expanded with the functions of a debit card.

Since the Wise Card is considered an extension of the existing service offering rather than a standalone product, we will highlight both the advantages of the Wise Card itself and the benefits of Wise’s broader services. The Wise Card complements the existing features and provides additional advantages, which we’ll explain in more detail.

All advantages of the Wise Card at a glance:

✅ Currency accounts – pay in local currencies

✅ No annual fee

✅ Easy application without a credit check

✅ Apple Pay and Google Pay connectivity

Currency accounts – pay in local currencies

Wise allows you to hold accounts in up to 50 different currencies. With these versatile accounts, you can both receive international payments and send money abroad.

In addition, your Wise Card lets you pay directly in the respective currency of your account – a real benefit if you frequently travel to different countries or shop internationally. The card can be used in over 200 countries.

Let’s say you’re planning a trip to Thailand. With Wise, you can set up an account in the local currency, the Thai baht, beforehand. You can top up this account with euros, and Wise will convert the amount into baht. This conversion is done at Wise’s exchange rate – not the often less favorable rates local banks might charge.

Once you arrive in Thailand, you can use your Wise Card to pay in baht without additional charges, making you independent of local exchange rates. However, a conversion fee applies, which ranges between 0.5 percent and 1.0 percent, depending on the currency pair.

No annual fee

Using the Wise Card, as well as Wise’s other services, is free of charge. This means you don’t pay any account maintenance or card fees.

💡 Note: When you order a Wise Card, there is a one-time fee of 7 euros for the physical card.

Despite the essentially free use of the account and Wise Card, you should keep in mind that certain services do come with costs. For example, fees apply when you make a currency conversion.

Payments made in the currency of your account are always free of charge. The Wise Card fees, however, are communicated in a fully transparent way.

Easy application without a credit check

Another advantage of the Wise Card is its user-friendliness, especially when it comes to the application process. Unlike traditional credit cards, which often involve a complex and time-consuming approval procedure, applying for the Wise Card is simple and straightforward.

It’s important to note that applying for the Wise Card does not require a Schufa report or any other form of credit check.

In this respect, Wise differs from many traditional banks. Credit cards without a credit check are ideal for people with less-than-perfect creditworthiness or for freelancers who do not have a steady or regular income.

Apple Pay and Google Pay connectivity

As a modern company, Wise of course also offers the option to link your Wise Card with Apple Pay, Google Pay and Garmin Pay. This allows you to securely store your card on your smartphone or smartwatch and make contactless payments – particularly convenient.

The Wise app allows you to conveniently manage your accounts and cards, exchange money into different currencies, and send transfers to friends, family, or businesses around the world – all from your phone. The app also provides real-time notifications about account activity, making it easier to stay on top of your finances.

What are the disadvantages of the Wise Card?

Now that we’ve looked at the advantages of Wise’s services and its debit card, let’s take a closer look at the drawbacks and weaknesses of the Wise Card.

Although the Wise Card is known for its simplicity, convenience, and cost efficiency in international transactions, there are certain aspects where it may not always be the best option.

All disadvantages of the Wise Card at a glance:

⚠️ Fees for cash withdrawals

⚠️ No credit line

⚠️ No additional benefits

Fees for cash withdrawals

Wise allows you to maintain accounts in multiple currencies free of charge, which at first glance makes the Wise Card seem perfect for withdrawing cash both at home and abroad. However, that’s not entirely the case.

Wise advertises that you can withdraw cash worldwide for free with the Wise Card. However, free withdrawals are limited to two per month and a maximum total amount of 200 euros. Once you exceed either of these limits, fees apply when withdrawing money with the Wise Card.

If you make more than two withdrawals but stay under the 200 euros limit, the fee is 0.50 euros per withdrawal. Once the 200 euros “free allowance” is exceeded, every further withdrawal with the Wise Card incurs an additional fee of 1.75 percent.

So, if you plan to use the Wise Card for more than just occasional cash withdrawals, you should be aware of these charges.

No credit line

As mentioned earlier, the Wise Mastercard is a debit card, not a traditional credit card with a credit limit you can freely access.

In other words, you can only spend money that you already have in your Wise account. On the one hand, this provides a certain level of security and control over your spending, but on the other hand, it significantly limits financial flexibility.

Using a debit card can be particularly inconvenient when traveling. Many hotels and car rental companies accept only real credit cards for reservations and for holding a deposit. With these, it is possible to block a certain amount if needed, which can then be used to cover potential damages or additional costs.

So, if you’re planning to rent a car on your next trip, you won’t get around needing a traditional credit card with rental car insurance – such as the Barclays Platinum Double.

Barclays Platinum Double

Promotion: 50 euro starting bonus

- Free cash withdrawals worldwide

- Free transactions worldwide

- Free platinum partner card

- Travel cancellation insurance

- Worldwide health insurance

- Rental car insurance

No additional benefits

Another major drawback, where the Wise Card lags behind many other providers, is the complete lack of extra perks.

While many traditional credit cards offer additional advantages such as insurance coverage, reward points for purchases, airport lounge access, and other loyalty benefits, the Wise Card does not include any of these extras.

Admittedly, you can hardly expect such extras from a free debit card. However, many providers now allow you to add these kinds of benefits individually, tailored to your needs, for an additional fee. With the Wise Card, this option does not exist.

If you’re looking for a credit card that offers extensive protection and comfort while traveling, you’ll be much better served with a dedicated travel credit card.

How can you apply for the Wise Card credit card?

As with most debit cards, applying for the Wise Card is quite simple and does not require a Schufa report or similar credit check – thats why the Wise Card can also perfectly be used as a credit card for asylum applicants. You can apply for the Wise Mastercard in just a few steps directly through the Wise website:

- Open a Wise account: First, you’ll need to open a Wise account. Only some basic personal details are required. After registration, your identity must be verified. For this, you’ll need an identity document (passport or national ID card), proof of address (such as a utility bill or tax statement), and a personal photo.

- Make an initial deposit: Before you can order the Wise Card, you must top up your Wise account from another bank account. Important: The money must come from a bank account registered in the same name as your Wise account.

- Order the Wise Card: Once the funds have been credited to your account, you can order the Wise Card. There is a one-time fee of 7 euros for the physical card. Optionally, for an additional 10.40 euros, you can choose express delivery within one to two business days.

Wise Debit Mastercard

- Free digital debit Mastercard included

- Withdraw up to 200 Euro per month free of charge

- Pay in local currencies at live exchange rates

- No Schufa check required

- Apple Pay and Google Pay compatible

Who is the Wise Mastercard suitable for?

The Wise Card is without a doubt a solid product and a useful addition to Wise’s existing services. However, as a free debit card, it does come with certain weaknesses and limitations.

On the one hand, acceptance can be somewhat restricted – especially with car rental companies and hotels, which often require a traditional credit card. On the other hand, the Wise Card lacks additional benefits such as insurance coverage or rewards programs that many other credit card providers offer their customers.

The Wise Card is therefore an excellent option for occasional travel or for people who are primarily looking for a cost-effective way to transfer money internationally or pay in foreign currencies.

For frequent travelers who want to benefit from the additional perks of a dedicated travel credit card, however, the Wise Card may not be the best choice. Other providers are much better positioned here – and in many cases, these “better” cards don’t even come with an annual fee.

💡 Info: Wise also offers a business credit card that allows employees in over 70 countries to make payments – without hidden exchange rate fees.

What are the experiences with the Wise Card credit card?

On the review platform Trustpilot, Wise Card experiences are predominantly positive. Users praise the simple and fast processing of international transfers as well as the transparency of the fees.

Many customers appreciate the user-friendliness of the app and the clear exchange rates, which involve no hidden costs. The customer support is also frequently praised for its efficiency and helpfulness.

However, there are also some critical voices reporting occasional technical issues and delays during the verification process.

Overall, Wise stands out for its high level of customer satisfaction, as reflected in the numerous positive reviews on Trustpilot. Based on more than 270,000 reviews, Wise has received an overall rating of “Excellent.”

How did we test the Wise Card credit card?

Our recommendations are always based on predefined criteria, which we use to evaluate the credit cards. Based on these tests, we then give either recommendations or point out objections and, if necessary, refer to alternatives.

Some of the most important criteria for our tests include the fee structure, the application process, day-to-day usability, the type of billing, and the additional benefits promised by the account provider. We then share our findings in detailed guides like this one, as well as in our comprehensive credit card comparison.

In order to find the best financial products for you, we have been conducting independent and comprehensive comparisons for years. To do this, we test offers according to fixed criteria such as fees, services, and customer service, and compare the results transparently. This way, you can be sure to make a well-informed decision.

Have our reisetopia financial tips helped you? Then please rate us on Trustpilot!

What are the alternatives to the Wise Card credit card?

In case you’ve realized while reading this article that the Wise Card doesn’t fully match your needs, we’ve listed some of the best Wise Card alternatives here.

The debit card market offers a wide range of options with diverse benefits and features. Our top selection of free debit cards includes the following three, which stand out from many other providers mainly thanks to their attractive additional benefits.

N26 Mastercard

The N26 Mastercard is a debit card issued by the German neobank N26. With this card, the bank combines the advantages of a travel credit card with those of an innovative current account. Cardholders benefit from free cash withdrawals in Germany and across Europe, no foreign currency fees, and a modern banking app that operates in real time.

N26 MasterCard

- Permanently without annual fee

- Free payments worldwide

- Free cash withdrawals in the Euro-zone

- Free bank account included

Trade Republic Credit Card

The Trade Republic Credit Card also stood out in our comparison and ranks among the top three free credit cards in Germany. The card is particularly appealing thanks to its 1 percent cashback on payments. In addition, it is permanently free of charge, and you can make payments worldwide without fees.

Trade Republic Card

- Free credit card – permanently without annual fee

- Free payments worldwide

- Free cash withdrawals worldwide starting at 100 Euro

- 1 percent saveback – on card spending

DKB Visa Card

The DKB Visa Card also combines numerous advantages, making it an attractive choice for a wide range of customers. With a free current account for active customers and the ability to withdraw cash and make payments worldwide without fees, this debit card offers extensive financial flexibility for both travel and everyday use.

DKB Credit Card

- Free cash withdrawals worldwide

- Free payments worldwide

- Free checking account with active use

- Emergency package abroad

- Resident in Austria? Then apply here

Our conclusion on the Wise Card credit card

The Wise Card credit card is a great option for making payments in foreign currencies at comparatively good exchange rates. In our opinion, however, the Wise Card is not suitable as a primary travel credit card, and there are several reasons for this. On the one hand, debit cards like the Wise Card are not always accepted everywhere – especially by car rental companies and hotels, which often require a real credit card.

On the other hand, the Wise Card does not provide any additional benefits or insurance services that many other travel credit cards include. And finally, you are quite limited when it comes to free cash withdrawals. Nevertheless, we can recommend the Wise Card to anyone who is simply looking for a cost-effective way to pay in foreign currencies.

Wise Debit Mastercard

- Free digital debit Mastercard included

- Withdraw up to 200 Euro per month free of charge

- Pay in local currencies at live exchange rates

- No Schufa check required

- Apple Pay and Google Pay compatible