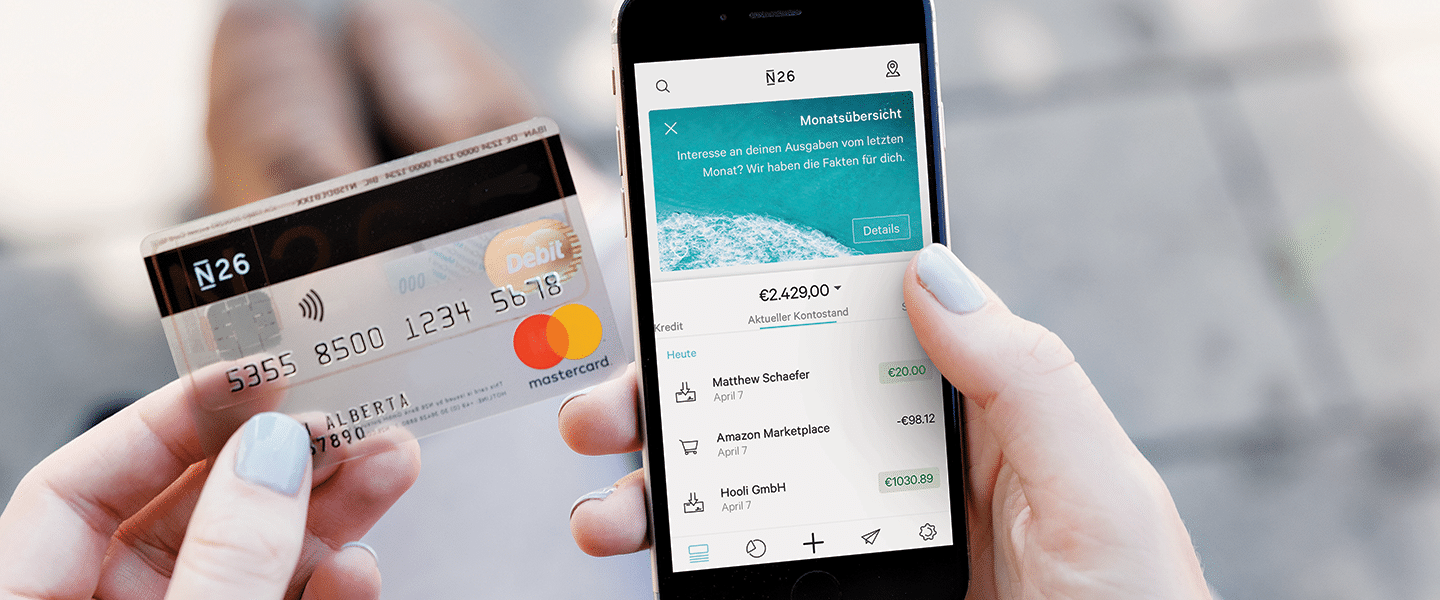

The N26 credit card is one of the most interesting products on the German credit card market, as this modern neobank does things differently. The N26 Mastercard is a debit card that offers a number of advantages, including while travelling.

N26 MasterCard

- Permanently without annual fee

- Free payments worldwide

- Free cash withdrawals in the Euro-zone

- Free bank account included

In this guide, we highlight what you need to look out for. We take a comprehensive look at the advantages and disadvantages of the N26 credit card and share our personal experiences.

💡 Please note: The N26 Mastercard is officially a debit card, meaning all payments are debited directly from your current account. However, due to its more common usage, the term ‘credit card’ is also used in this article.

Inhaltsverzeichnis

- What is behind N26 Bank?

- What are the advantages of the N26 credit card?

- What are the disadvantages of the N26 credit card?

- What are the requirements for applying for the N26 credit card?

- Who would benefit from the N26 credit card?

- What is our experience with the N26 credit card?

- What alternatives are there to the N26 credit card?

- Our conclusion on the N26 Mastercard credit card

What is behind N26 Bank?

Founded in Berlin in 2013 by Valentin Stalf and Maximilian Tayenthal, N26 Bank has established itself as a pioneer in the field of modern, fully digital banking. It is Europe’s first mobile-only bank with a full German banking licence from BaFin.

N26’s vision is to change people’s relationship with money for the better. It offers its users a new level of freedom when it comes to managing their banking transactions.

Thanks to its intuitive design, state-of-the-art security features and commitment to transparency and financial control, N26 aims to make banking simple and straightforward for its customers.

According to its own figures, N26 Bank now has over 8 million customers and operates in many European countries and the USA.

The bank generally only issues Mastercard credit cards. Consequently, there is no N26 Visa or N26 Visa credit card.

What are the advantages of the N26 credit card?

The most important advantage of the N26 credit or debit card is undoubtedly that it is free. This means that no annual fee is payable in the first year or subsequent years. However, the Mastercard from N26 offers even more benefits:

All the benefits of the N26 card at a glance:

💳 Free virtual Mastercard

📈 Current account with no maintenance fees

🌍 Fee-free payments worldwide

💵 Cash withdrawals with Cash26

💰 Free instant access savings account available in the app

Current account with no maintenance fees

One of the key advantages of applying for the N26 credit card is that you automatically receive a free current account. N26 stands out as the first fully digital bank, and this is particularly evident in the range of functions offered by the current account, so it is worth taking a look at it.

All transactions, including transfers, receiving money and managing funds, are primarily carried out via the N26 mobile app.

It is also worth noting that the N26 credit card is an attractive option for students. Moreover, it is notable for its accessibility, even for those on lower incomes who often struggle to obtain a worldwide card with favourable terms and conditions.

With N26, you can choose from five different account models to find the one that suits you best. The following N26 account options are available, along with their respective costs:

| 💳 Account model | 💰Price |

| N26 Standard | free of charge |

| N26 Smart | 4.90 euros per month |

| N26 Flex | 8.90 euros per month |

| N26 Go | 9.90 euros per month |

| N26 Metal | 16.90 euros per month |

In addition, the N26 bank also offers business accounts under the name N26 Business. With these accounts, the N26 Mastercard offers additional cashback: 0.1 percent for the N26 Business Standard and N26 Business Smart accounts, and 0.5 percent for the N26 Business You and N26 Business Metal accounts. Unfortunately, there is no N26 cashback for cards used for personal expenses.

The cards you receive will depend on the account model. If you opt for the free N26 Standard model, you will only receive a virtual N26 Mastercard. However, you can add a physical card for a one-off fee of 10 euros. This should be taken into account when calculating the cost of the N26 credit card.

With the N26 Smart and N26 Go (formerly N26 You) accounts, you receive one free physical card. You can add an additional card for a fee. The premium N26 Metal account includes an exclusive metal card. Therefore, the general N26 credit card costs are limited to the possible account maintenance fee. However, you should take a closer look at the physical card for the standard model.

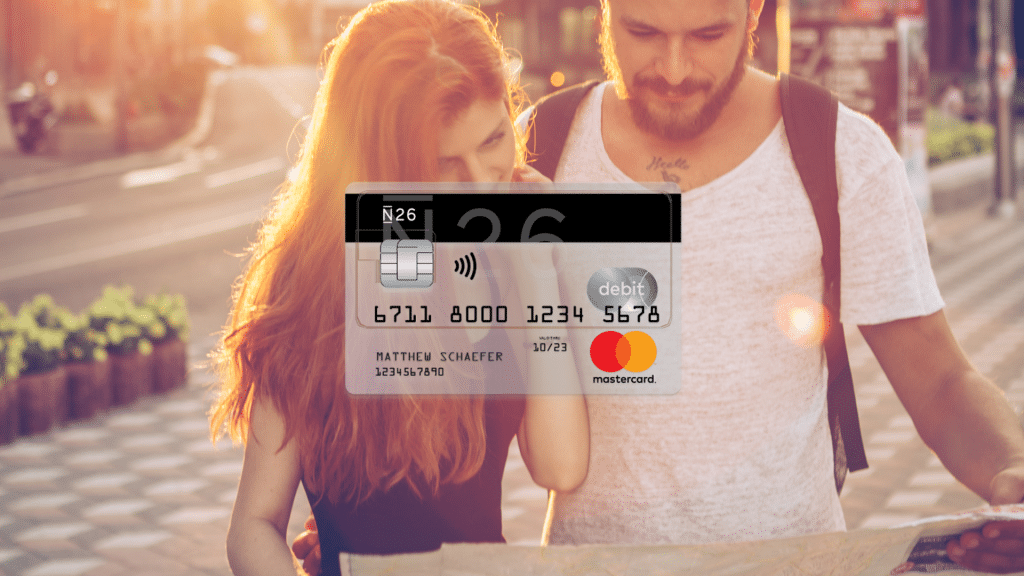

Fee-free payments worldwide

Another advantage of the N26 Mastercard is that you can make fee-free payments worldwide. This makes the N26 Mastercard an attractive option for travellers.

So, if you pay in a currency other than the euro while abroad, you won’t incur any foreign currency fees. You only pay the current Mastercard exchange rate, which is generally quite reasonable.

Another advantage is that Mastercard cards are widely accepted around the world. This means that the included card can be used in the United Kingdom and abroad.

Cash withdrawals with Cash26

Withdrawing cash with your N26 Mastercard is generally not a problem and can be done free of charge. However, there are a few rules that users must follow to ensure this remains the case.

As part of its fair use policy, N26 allows you to make a certain number of free domestic cash withdrawals per month, depending on your account model. You can withdraw cash free of charge between two and eight times a month within Germany, depending on your account model. You can deposit a maximum of 999 euros per day via Cash26.

However, within the EU, you can withdraw cash as often as you like, regardless of your account type. In other EU countries, such as the US and the UK, fees apply to N26 Standard and N26 Smart accounts.

Overview of free withdrawals with the N26 Mastercard:

| 💳Account and card model | 💵Free withdrawals |

| N26 Standard & N26 Business | two per month |

| N26 Smart & N26 Business Smart | three per month |

| N26 Go & N26 Business Go | five per month |

| N26 Metal & N26 Business Metall | eight per month |

Another free option for cash withdrawals is the Cash26 programme:

With CASH26, you can withdraw cash for free at over 11 900 shops in Germany, and deposit cash for a fee of 1.5 percent. Partners include supermarkets and drug stores such as REWE and dm.

Transactions are carried out via the N26 app, which generates a barcode to be scanned at the checkout. This means that you don’t even need to carry your card with you.

The N26 credit card is an excellent choice for anyone who stays within the withdrawal limits and does not exceed the number of free withdrawals, especially within Europe. However, if you regularly withdraw large amounts of money, you should keep an eye on the costs associated with the N26 credit card.

Free instant access savings account available in the app

Another practical feature of the N26 credit card is the ability to open a free instant savings account (Tagesgeldkonto) directly through the N26 app. Depending on your chosen account model, you can earn competitive interest rates on this account.

This allows you to manage your savings efficiently, benefiting from interest income without having to switch between different banks or platforms. The instant access savings account is straightforward to set up and manage within the app, and provides a good overview. While the interest rate is not particularly high, it is reasonable for a free account.

N26 MasterCard

- Permanently without annual fee

- Free payments worldwide

- Free cash withdrawals in the Euro-zone

- Free bank account included

Finally, it is worth noting that the N26 credit card is compatible with both Apple Pay and Google Pay.

What are the disadvantages of the N26 credit card?

However, as is often the case, there are some pitfalls as well as advantages that you should be aware of. The main issues relate to the card type, cash withdrawals, and the lack of travel insurance with the free Mastercard.

Debit card instead of credit card

The biggest disadvantage of the N26 credit card is probably that the N26 Mastercard is actually a debit card, not a credit card. In fact, the term ‘N26 debit card’ is more accurate. The term ‘N26 prepaid credit card’ is also widely used, but this is not technically correct.

Unlike a credit card, a debit card debits funds directly from your current account. This means that, unlike with a Barclays Visa card, for example, you do not receive a credit limit.

Depending on your preferences, this can be an advantage or a disadvantage. Otherwise, payments are made in the same way as with other cards, which is why the N26 card is often referred to as a credit card.

Limited cash withdrawals at ATMs

Another aspect to consider with the N26 credit card is cash withdrawals. As previously mentioned, this card is ideal for withdrawals within the Eurozone.

Outside this area, a withdrawal fee of 1.7 percent is charged for all withdrawals with the Standard or Smart versions. Withdrawals outside the eurozone are only free of charge with N26 Go and N26 Metal.

In this regard, other cards that offer free withdrawals worldwide provide significantly better value for money. The fair use policy for free withdrawals within Germany may also be less than ideal for cash users.

The N26 card may not be the optimal solution for users who regularly require cash. The Revolut current account could be a good alternative.

Lack of travel insurance

One minor drawback is that the free credit card does not come with travel insurance. Although premium models offer travel insurance, such as medical assistance abroad or travel cancellation insurance, they cost almost as much as the Barclays Platinum Double or the American Express Gold, which offer more attractive insurance packages.

Purely online bank

One disadvantage of N26 Bank is that it operates purely as an online bank with an exclusively digital presence. Anyone who prefers to have personal contact with bank employees in physical branches, or who considers this to be necessary, may feel restricted by N26.

Although interaction with the bank primarily takes place via the mobile app, ensuring flexible and time-efficient account management, direct human interaction is lacking.

The lack of a personal contact can be problematic, particularly when it comes to complex matters or specific questions. Although N26 offers various communication channels, such as chat and email support, digital communication cannot fully replace personal conversations.

What fees are charged for the N26 credit card?

As with any financial product, the fee structure is an important consideration. The fees for the free N26 Standard model are broken down below:

| 🧾 Service: | 💰 Price: |

| Physical Mastercard | One-off payment of 10 euros |

| Cashless payments worldwide | Free of charge |

| Withdrawals at ATMs in Germany | Twice a month free of charge; thereafter 2 euros per withdrawal |

| Withdrawals in the euro area (except Germany) | Free of charge |

| Withdrawals in foreign currency | 1.7 percent of turnover |

| Cash26 cash withdrawals | Free of charge |

| Cash26 deposits | 1.5 percent of turnover |

| Outgoing SEPA real-time transfers | Free of charge |

Many of the fees for the N26 Mastercard listed here can be avoided by choosing a higher subscription level. With the N26 Go and N26 Metal plans, for instance, withdrawals in foreign currencies are free of charge and the physical credit card is included as standard from the Smart plan onwards. Since the beginning of 2025, real-time transfers have also been free at N26.

What are the requirements for applying for the N26 credit card?

Applying for an N26 credit card is straightforward. In our experience, the combined product does not have a particularly high entry threshold. Nevertheless, N26 lists a number of criteria on its website that must be met in order to successfully apply for a credit card.

🎂 At least 18 years old

🌍 Live in a supported country

📱 Have a compatible smartphone

📝 Not have an existing online N26 account

🪪 Have a valid ID document that is recognised in your country of residence

💬 Be able to verify your identity in one of the supported languages (German, English, Spanish, French or Italian)

If you meet the criteria, you can easily order an N26 card via the app. A credit check will also be carried out when you apply for the N26 Flex account. However, this will not usually have a long-term negative impact on your credit rating.

Once you have completed all the necessary steps, you can open your account online. Once your identity has been verified, your account will be activated and your virtual credit card will be ready to use immediately.

If you opted for a physical card too, it will arrive within the next 10 working days. You can then activate it via the app and start using it right away.

💡 Please note: N26 now offers accounts and cards in several other countries, including Austria, Italy, Switzerland, France, Spain and the Netherlands. So, if you move to one of these countries, you can still use N26. Please note, however, that not all services are available in every country, nor are they necessarily identical to those in Germany.

You can then easily add the N26 Mastercard to your digital wallet and use it to make mobile payments. You can do this immediately after opening an account, even with the standard model, which does not require you to order an N26 card. Upgrading to a higher model can also be easily done via online banking or the app.

Who would benefit from the N26 credit card?

The N26 credit card and current account package is a good option for anyone looking for an up-to-date account with favourable terms and conditions.

This combined product offers a current account and a Mastercard with no mandatory fees. However, it is also worth exploring the different options offered by N26 to find the right account and card for your needs!

A brief comparison of the most important aspects of the N26 account models:

| N26 Standard | N26 Smart | N26 Go | N26 Metal | |

| Fee | Free of charge | 4,90 Euro | 9,90 Euro | 16,90 Euro |

| Card | Virtual | Virtual & physical | Colourful | Made of metal |

| Withdrawals | Two free of charge | Three free of charge | Five free of charge | Eight free of charge |

| Insurances | No | No | Included | Extended |

| Customer service | Chat only | Also by telephone | Also by telephone | Also by telephone |

Thanks to its simple application process and low entry threshold, the N26 Standard account is particularly appealing to students or asylum applicants. The Metal account model offers a range of useful travel insurance policies, which are particularly appealing if you travel frequently.

N26 is also a good choice for anyone who simply needs an additional, straightforward current account. However, N26 is also ideal for use as a main account, complete with a debit card. You can enjoy a free account and intuitive banking via the N26 app.

We would advise against N26 for anyone who wants a bank account with a branch network or personal contact.

N26 is an online-only bank with no physical branches. If you have any questions about your account, the standard model only offers a chat service. If you opt for one of the premium models, however, you will also receive telephone support. There is still no personal direct contact, though.

We would advise against this card for anyone who does not want to do all their banking via a smartphone. Although the premium models from N26 are now worth considering, we were ultimately more impressed by Revolut Metal or Revolut Ultra due to their additional RevPoints programme.

What is our experience with the N26 credit card?

I have had the N26 credit card for almost five years and am very happy with it. Below, I will share my experiences of using the N26 credit card:

I use the free standard version of the N26 debit card as an additional current account. It allows me to manage my money via a really well-designed app. I also find it incredibly valuable that I’m not limited to one bank for cash withdrawals.

I can get cash via Cash26 at the supermarket, or withdraw money free of charge at many Sparkasse or Volksbank ATMs. For guaranteed acceptance at ATMs beyond digital methods, I recommend ordering the N26 card, which I found easy to do.

As a user of the free card, I have no problem with the fact that customer service is only available via chat. All my difficulties and concerns have been resolved satisfactorily this way so far.

I registered the virtual credit card with Apple Pay and now always use it to pay when my American Express® credit card is not accepted.

Provided that the account remains free of charge, I am sure that I will continue to be a customer of N26.

What alternatives are there to the N26 credit card?

Among the free credit cards, there are a wide variety of models from a wide range of banks. Our favorites among the free credit cards include the following three cards in particular:

Hanseatic Bank GenialCard

The Hanseatic Bank GenialCard is an excellent choice for anyone who values financial freedom and fair terms and conditions. With no annual fee, free payments worldwide, and free cash withdrawals abroad, it clearly stands out from other credit cards.

Thanks to its ease of use and flexible repayment options, it is a reliable companion not only when traveling, but also in everyday life. For us, the Hanseatic Bank GenialCard is the number one recommendation for anyone who values convenience and transparency.

Hanseatic Bank GenialCard

- 0 euro annual fee

- Free payments worldwide*

- Free cash withdrawals worldwide**

- Repayment in small and flexible installments

TF Bank Mastercard Gold

Among the free Mastercards, TF Bank’s gold credit card is also one of our top recommendations. This free credit card is a reliable companion when traveling, as there are no foreign currency fees, meaning payments can be made worldwide free of charge.

The included travel insurance rounds off the package and makes the TF Bank Mastercard Gold a highly recommended travel credit card. Anyone who needs additional liquidity will find the TF Bank credit card an attractive option, as the TF Bank Mastercard Gold offers an interest-free payment period of 51 days, which means that cardholders receive free credit for this period.

TF Bank Mastercard Gold

- Free credit card

- Payments worldwide without any fees

- Travel cancellation insurance included

- Foreign health insurance included

Barclays Visa

The Barclays Visa Credit Card is also a promising choice among free credit cards. It offers fee-free cash withdrawals and payments worldwide, making it an indispensable companion when traveling.

In addition, it offers an interest-free credit limit of up to two months, providing financial flexibility at no extra cost. With these advantages, the Barclays Visa is the perfect choice for anyone who values reliability and cost efficiency.

Barclays Visa Credit card

- Free credit card

- Free cash withdrawals worldwide

- Free payments worldwide

- Free loan up to 2 months

Our conclusion on the N26 Mastercard credit card

The N26 credit card is a smart product and, in some respects, is certainly one of the best mobile accounts with a Mastercard on the market. The Debit Mastercard is an exciting alternative, particularly for school pupils and students, who often find it difficult to apply for a credit card. This is because the terms and conditions are significantly better than those offered by almost all German branch banks!

N26 MasterCard

- Permanently without annual fee

- Free payments worldwide

- Free cash withdrawals in the Euro-zone

- Free bank account included